March 11, 2024

Is eCommerce front and center when consumer brands present their strategy?

We were able to test that hypothesis when thirty brands presented at the CAGNY conference, a long-running industry event primarily designed for investors to assess the short- and long-term strategies of some the largest companies in the industry.

The event is by no means meant to focus on digital themes, which makes it all the more interesting to assess how companies are incorporating digital into their broader vision and strategy.

Like our review last year, we wanted to see what we could learn from the presenting companies on the outlook for consumer brands in 2024 and the ways in which companies are leveraging digital to drive growth and profits.

After reviewing more than 1,000 slides and hundreds of pages of transcripts, here are the 10 themes:

- Inflation and price increase dynamics are pressuring near-term revenue, but companies have maintained their long-term organic sales targets even if 2024 might come in a little light, with profitably outlooks largely positive and providing these brands the ability to invest into digital capabilities and other initiatives.

- Brands are relying on product innovation and increases to media, advertising, and promotional budgets to drive growth in 2024.

- eCommerce has contributed ~40-50%+ of incremental dollar growth for consumer brands over the last several years, reinforcing the omnichannel focus of essentially every brand that presented.

- Amazon is such a juggernaut that it was the most frequently brought up retailer in a variety of contexts, including companies showing their favorable ratings and reviews on the site to featuring it as the epitome of what “eCommerce” means to them.

- Improving media effectiveness and efficiency is front and center for brands, with an increasing amount of spend going towards digital media where advanced measurement, targeting and personalization is possible.

- Companies shared an impressive number of specific Generative AI applications including speeding up content creation and developing new product innovations.

- New product innovations are increasingly being launched online first and then expanding into brick & mortar (B&M) channels, a reversal of past practices when companies would port whatever they offered in stores into online channels.

- Like last year, Direct to Consumer (DTC) excellence was harder to discern for most presenting brands, although there were several examples shared of brands leveraging first-party data in different ways.

- While Amazon, Walmart, and others were mentioned in several presentations, emerging channels like TikTok Shop were not mentioned often.

- Moving faster was a theme that emerged from a small percentage of the presentations, enabled by close social listening and advanced data and analytics.

For Digital Leaders eager to bring back insights from CAGNY to their organization, we dive further into three prominent themes from the presentations:

- The contribution from eCommerce to financial results

- The role digital is playing in product innovation, from where to launch to ideation

- Data-driven media changes, including measurement, targeting, and personalization

The Contribution from eCommerce to Financial Results

Over the last 12 months, shares of CPG companies have underperformed the broader market as investors foresaw challenges to continued growth given the post-pandemic playbook of relying on price increases grew tired.

While revenue is projected to grow in 2024 for CPG, a deceleration is expected. For instance, in the specialty foods sector, which includes presenting companies like Mondelez and Hershey, growth is projected to reach 2.2% y/y in 2024 compared to 6.6% in 2023.

The Household and Personal Care category, which includes companies like P&G and Kenvue, is forecasting more stable trends with growth projected up 3.1% y/y in 2024 compared to 3.3% in 2023.

These growth outlooks aren’t particularly bad, but more so less good. Price increases will contribute less, and the consumer is facing 25% higher prices when they go to the grocery store. When combined, this presents a more challenging environment to grow.

Fortunately, the profit outlook for presenting brands was positive, with most projecting earnings growth ahead of sales growth. This provides CPG brands with the capacity to invest into digital capabilities that can fuel both long-term and short-term growth.

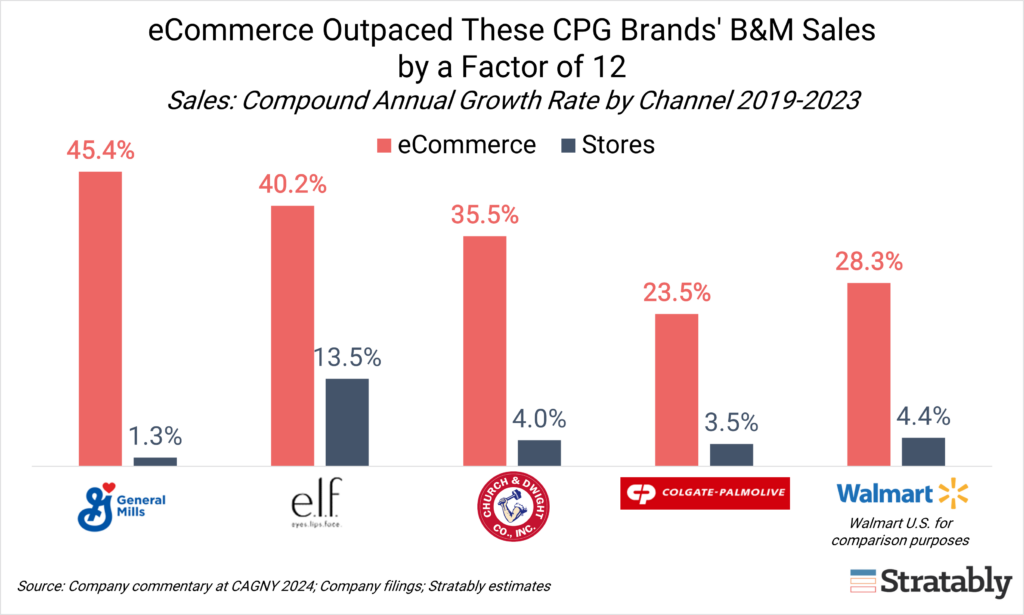

General Mills, Church & Dwight, Colgate-Palmolive, and e.l.f. Beauty all provided information on their current and historic digital penetration rates that can be used to illustrate the impact from eCommerce in recent years.

When combined, eCommerce accounts for 15.7% of the revenue for these four companies, up from 6.2% pre-pandemic. This 9.5 percentage point gain translates to eCommerce having amounted to 56% of the incremental dollar growth from 2019 to 2023 for these four businesses. Further, online sales outpaced their store-based sales by a factor of twelve!

For comparison purposes, Walmart U.S., Target, and Kroger saw their eCommerce businesses contribute 40% of their total incremental dollar growth over that same period, with online outpacing store growth by a factor of six.

This is not an anomaly either, as our conservative projections across Mass, Grocery, Club, Convenience, Home Improvement, Home and Drug call for eCommerce to contribute more than half of incremental dollar growth in the U.S. retail market between 2023 and 2027.

Of course, the four companies that shared their figures at CAGNY may or may not be representative of all 30+ that presented. But nonetheless, the above analysis helps demonstrate the point that consumer brands can expect meaningful dollar contributions from eCommerce growth despite it still accounting for sub-20% of their total business.

Digital leaders that want to get more support for their initiatives can do the same analysis to help their senior leadership teams understand that eCommerce is critical to maximizing their growth goals not just in the long-term, but this year, when growth is harder to come by.

Digital’s Role in Product Innovation

EVERY company presentation at CAGNY included plans to launch innovative new products, with several companies including how they were using online to do so successfully.

Rather than an afterthought, digital is increasingly a powerful tool for product innovation (such as developing new product ideas) and a pillar of the go-to-market strategy (often the first channel when bringing new products to market).

Product Development

Clorox shared a shocking example of putting AI to work in product innovation. They have developed an AI-enabled model that ingests search term data, social media data, and existing products in the market to identify potential whitespace opportunities. It then applies Generative AI to do digital prototyping, which has cut down on its innovation cycle times by 50%.

And this isn’t just theoretical as Clorox’s management team indicated: “We’re actually launching our first innovation this month that we developed (with this process). Start to finish, it took us only four months to do that.”

This example from Clorox, along with higher-level commentary from L’Oreal, demonstrates companies are identifying specific areas to apply AI, and then exhibiting the corporate willingness to follow through on the findings.

Launching Online First

While presenting companies didn’t directly say Amazon has become the go-to platform of choice for bringing new product innovation to market, their actions suggest its true.

There were two notable examples from Church & Dwight:

- The company shared its new Arm & Hammer Power Sheets product has already launched on Amazon (quickly becoming the #2 detergent sheet there) with plans to launch it nationally later this year. They had similar comments for their new HardBall litter product.

- Another example comes from its acquisition of Hero, an Amazon native brand it acquired in late 2022. The company has been able to take the products on Amazon and grow consumption of that business by 73%, demonstrating the power of omnichannel brands acquiring and then growing digital native brands.

Kraft Heinz illustrated the flexibility of bringing new products online with its swift (pun intended!) rebrand and launch of “Ketchup and Seemingly Ranch” product inspired by the culturally relevant Swift-Kelce budding romance.

Where did they launch the product?

Their own site and Walmart.com, touting it took them just 15 days to get the re-branded product for sale at Walmart.

McCormick too shared how they’re using online as the first port of call for their new products: “The exciting flavor maker blends…that target Gen Z consumers launched on direct-to-consumer in early January with great results. They are now also an omni-channel [product] and are selling out. They will begin shipping to some bricks-and-mortar customers by the end of our second quarter.”

Coty also specifically called out Amazon and the success with the launch of its new CoverGirl product, stating: “I am proud to share that it has already become the number one new makeup launch on Amazon.”

New Products Ready for the Digital Shelf

General Mills didn’t restrict the launch of its new Cheerios Veggie Blends product to online channels, but it made sure it was ready for the digital shelf from the start. The company had search-optimized content to show up in the top results, conversion-driving product detail pages, and ceded ratings and reviews to drive early product velocity.

Similarly, Conagra talked high level about developing SKUS with “modern product attributes that are all packaged and presented in very provocative ways to stand out on shelf or online.”

These two examples are straightforward in theory, but historically uncommon in practice. These examples of digital playing a more prominent role in product innovation and launch are diametrically opposed to past norms of focus groups, sales presentations to merchants, and reluctantly listing B&M assortment on online platforms in hopes it would sell profitably.

Data-Driven Media Revolution: Measurement, Targeting, Personalization, and Retail Media

Media measurement, targeting, personalization and retail media are some of the most exciting areas for professionals working in digital and eCommerce roles, heightened by Apple’s privacy initiatives, the death of the cookie, and the growth in eCommerce.

This is a broad area that can encompass everything from what companies are doing with data and analytics, to generative AI, to retail media.

Chief Analytics Officers Welcomed (and Clean Rooms)

Colgate-Palmolive invited its Chief Digital Officer Brigitte King to present at the 2022 CAGNY Conference, and for 2024 it invited its Chief Analytics and Insights Officer Diana Schildhouse to present the company’s data and analytics strategy.

The combination of these two invites speaks to the company’s focus on winning digitally while leading the charge on educating investors why success in digital media and eCommerce are important dimensions on which they should evaluate CPG companies.

One of the most notable areas Schildhouse commented on was its partnership with a specialty retailer to develop a clean room that allowed it to offer more precise targeting and personalized content in a privacy safe way.

This is notable as it is the first time we’ve seen a company talk about clean rooms at the CAGNY conference. Even investment analysts were caught off guard by the topic, including a question from one of the analysts: “So Diana, you talked about a partnership with a specialty retailer for this clean room. I’m not exactly sure what that is, but it sounds interesting and exciting.”

Interesting and exciting indeed (!) as clean rooms are increasingly a part of the modern marketer’s toolkit, and certainly the modern Amazon practitioner’s toolkit as well given Amazon is leading the way with its Amazon Marketing Cloud capabilities.

While Colgate-Palmolive was the only company to invite this type of role to present, Hershey highlighted its first ever Chief Data and Technology officer, Deepak Bhatia joining their company from Amazon.

In addition, General Mills indicated that since 2018, its data science team has increased 40-fold and now runs six million models per month compared to two thousand models per month five years ago.

The fundamentals of eCommerce are as important as ever, as are advanced capabilities. The deeper and more sophisticated a company can get in analytics and insights, the more the latter will come alive for them. As a result, we expect more companies to invite their eCommerce, digital, and analytics leaders to present in the future so that investors can more specifically understand how brands are unlocking greater reach and media efficiency.

AI Applications to Content Development & Personalization

Mondelez shared specific details on its use of Generative AI in speeding up and improving content creation, which it estimates is the area of marketing with the greatest value creation potential.

It is currently building different AI models “to help ideate, generate, produce and optimize assets” along with the capability to adjust this content by individual channel.

It sees the ability to rapidly scale content creation leading to greater personalization and higher media ROI over the long term, and it plans to test its early GenAI capabilities with its Milka brand this year.

Source: Mondelez, CAGNY 2024 presentation.

Retail Media Played a Minor Supporting Role at CAGNY 2024

Surprisingly, retail media did not come up as frequently as one would expect considering it is the fastest growing advertising type CPG brands are investing in (more here and here) and it is fundamentally changing how they do business with their largest retail customers.

In fact, companies were much more likely to mention their successful Super Bowl ads than what they were doing with retail media. The focus on the Super Bowl is understandable to a degree as (1) it is one of the few mass culture media opportunities available (and can thus have a meaningful impact) and (2) it is easier to communicate in a short presentation to investors.

However, we would have expected companies to share more specifics on how retail media is contributing to their stated goal of improving media efficiency as they increase spend.

Here are some of the more notable comments on retail media:

- Organizational Changes: WK Kellogg had the most to say about retail media from an organizational perspective. The company stated: “…the area of omni marketing is changing rapidly. eCommerce is growing. Retailer media and lower funnel digital conversion are becoming more important, and the blurring of online and offline sales is accelerating, all driven by more and more data. We have changed the way we operate here, integrating this team directly into the business and…we are investing in new capability and new partnerships that can drive value for shoppers.”

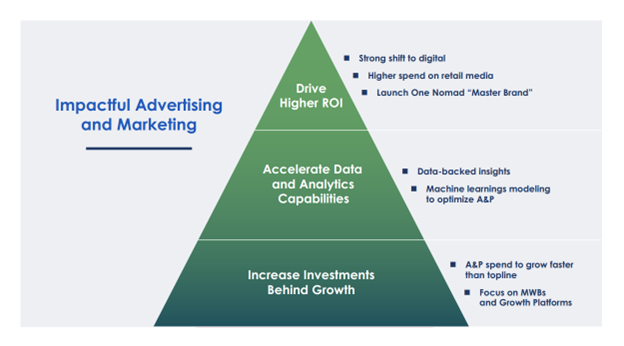

- Using Retail Media to Improve ROI: Nomad Foods indicated it is shifting more dollars to digital media and retail media in particular to drive a higher ROI and complement its in-store activations: “We’re also increasing our presence in the retail media channels to support our in-store activation.”

Source: Nomad Foods, CAGNY 2024 presentation.

- Practical Example of Integrating Retail Media: One the more practical examples shared came from Clorox where it highlighted a recent effort that combined national media, social, and PR with Walmart Connect to drive new households to stores featuring an end cap of its toilet wand starter kit. The retail media component included off-site media geotargeted to serve near stores with endcaps along with Walmart search targeting, all of which combined to increase its household penetration by 12.5% and performed at more than double its average ROI with Walmart Connect.

First-Party Data

Our takeaway on first-party data from CAGNY 2023 was that brands were getting good at collecting it, but it was unclear how they were putting it to use.

While this is still largely the case, some companies were able to share how they were making progress.

For instance, the Colgate-Palmolive clean room example discussed above included the integration of the company’s and retailer’s first-party data sets to enable the campaign.

In addition, General Mills stated: “We are also winning online through deepening our personalized connections and engagement with consumers through platforms like Bettycrocker.com, Pillsbury.com, Good Rewards and Box Tops for Education, we engage directly with more than 16 million consumers each month, and we expect to see that number grow as we’ve recently begun to integrate Blue Buffalo into our Good Rewards program.”

The company went on to share that it’s leveraging this data to specifically target private label grain bar buyers, resulting in a high-single-digit improvement to its ad effectiveness.

Since first-party data is at least partially about being able to reach those consumers more directly, Coca-Cola’s example of using connected packaging stood out. The company is using QR codes on packaging to be a portal into additional digital content that helps deepen its appeal with consumers. This is a topic we covered last year in our Product-as-a-Platform session whereby not only can QR codes and similar technologies be used to serve content but can also enable re-ordering, trialing, gifting, and more.

A Bright (Digital) Future Ahead

It’s understandable for digital leaders to be unsatisfied following CAGNY.

Too many companies spoke at too high a level when they described their digital initiatives. Super Bowl sizzle reels were more frequent than practical retail media investments underway. Some companies barely gave mention to online channels.

In other words, eCommerce wasn’t necessarily front and center for all consumer brands that presented their strategies.

But the arc is clear and there is a lot to be encouraged about.

Digital capabilities and opportunities continue to be featured and discussed in a more integrated way at this conference and off-the-record inside consumer brands.

- It’s a big deal for companies to invite their digital leaders to present.

- A company like L’Oreal sharing that it was angering customers for not selling its luxury items on Amazon would have been unthinkable a few years ago.

- In reference to eCommerce, Church & Dwight’s management team saying “…you got to get really good at this” means something.

It’s an exciting time to be working in digital!

Looking forward to CAGNY 2025, we expect companies to lean even more into sharing information on their digital strategies including practical examples as they educate investors on how modern commerce is unfolding and what it will take to not only stay relevant, but win.