January 10, 2024

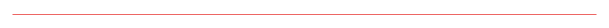

Stratably’s Amazon Competitive Edge Diagram maps out a variety of levers, program, and options brands have to grow their business on Amazon.

By breaking these levers down by adoption (x axis) and impact (y axis), you can see which ones are:

- Table stakes, like Sponsored Products (top-right quadrant, high adoption and high impact)

- Pullback opportunities, like Marketing Packages (bottom-right quadrant, high adoption but low impact)

- Test-and-learn opportunities, like Thursday Night Football Ads (bottom left quadrant, low adoption and low or unclear impact)

- Competitive edge opportunities, like AMC (top left quadrant, low adoption but high impact)

As the Amazon platform evolves rapidly, we shift, add to, and delete from the diagram to keep it as current as possible for brands looking to build their competitive edge.

Below outlines recent developments and insights on these levers, based on our conversations with dozens of brands and Amazon agencies.

Adoption growing for Manage Your Customer Engagement (MYCE) + new customer-centric tools

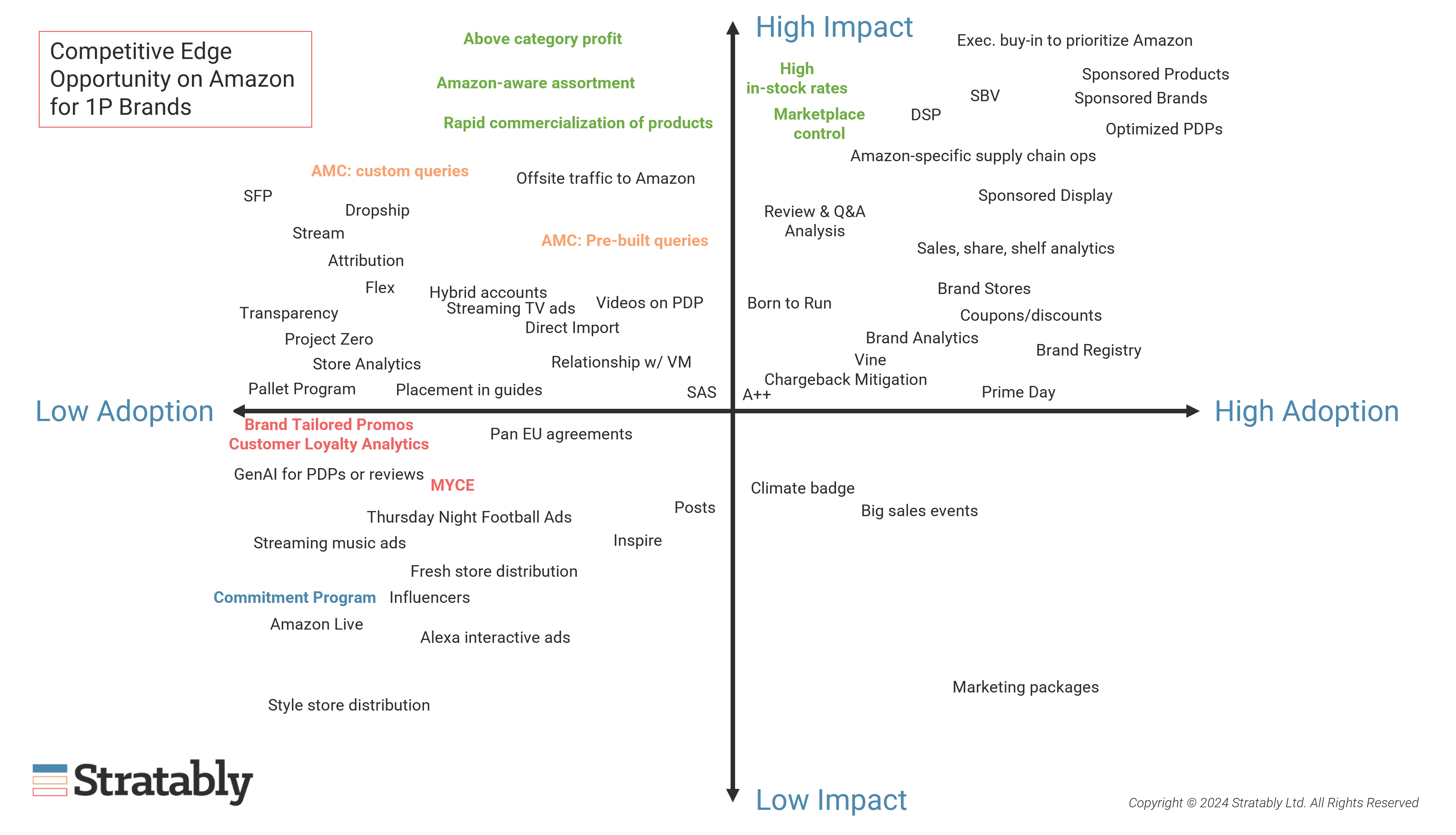

Amazon’s Manage Your Customer Engagement (MYCE) program allows brands to send marketing emails to audience segments like repeat customers, high-spend customers, recent customers, and brand followers.

This lever sits in the “test-and-learn” quadrant as it’s a newer program and feedback on impact to date has not been over-the-top positive. However, adoption has been growing. Brands are happy to test out this program as:

- It’s free to use

- It’s easy to use as Amazon offers templated emails

- It’s one of the few opportunities Amazon gives brands to directly engage with end customers

In the same vein of direct customer engagement, Brand Tailored Promotions allow you to send promotions to specific customer segments like potential new, top-tier, promising, and at-risk. And Customer Loyalty Analytics provide insight into the purchase patterns of each of these customer segments.

These two programs are newer than MYCE and adoption is more limited accordingly, although early feedback is positive. Further, Brand Tailored Promotions expanded to new markets more recently providing opportunities for global teams’ to participate.

Adoption growing for Amazon Marketing Cloud (AMC) with continuous room for progress

As a refresher, Amazon Marketing Cloud (AMC) is an analytics offering that provides novel access to and actionability from Amazon’s first party data. It allows you to answer a range of questions around how your consumers are finding and buying your products, with common use cases centered around optimizing Amazon ad spend across the funnel and identifying and then targeting high-value customers.

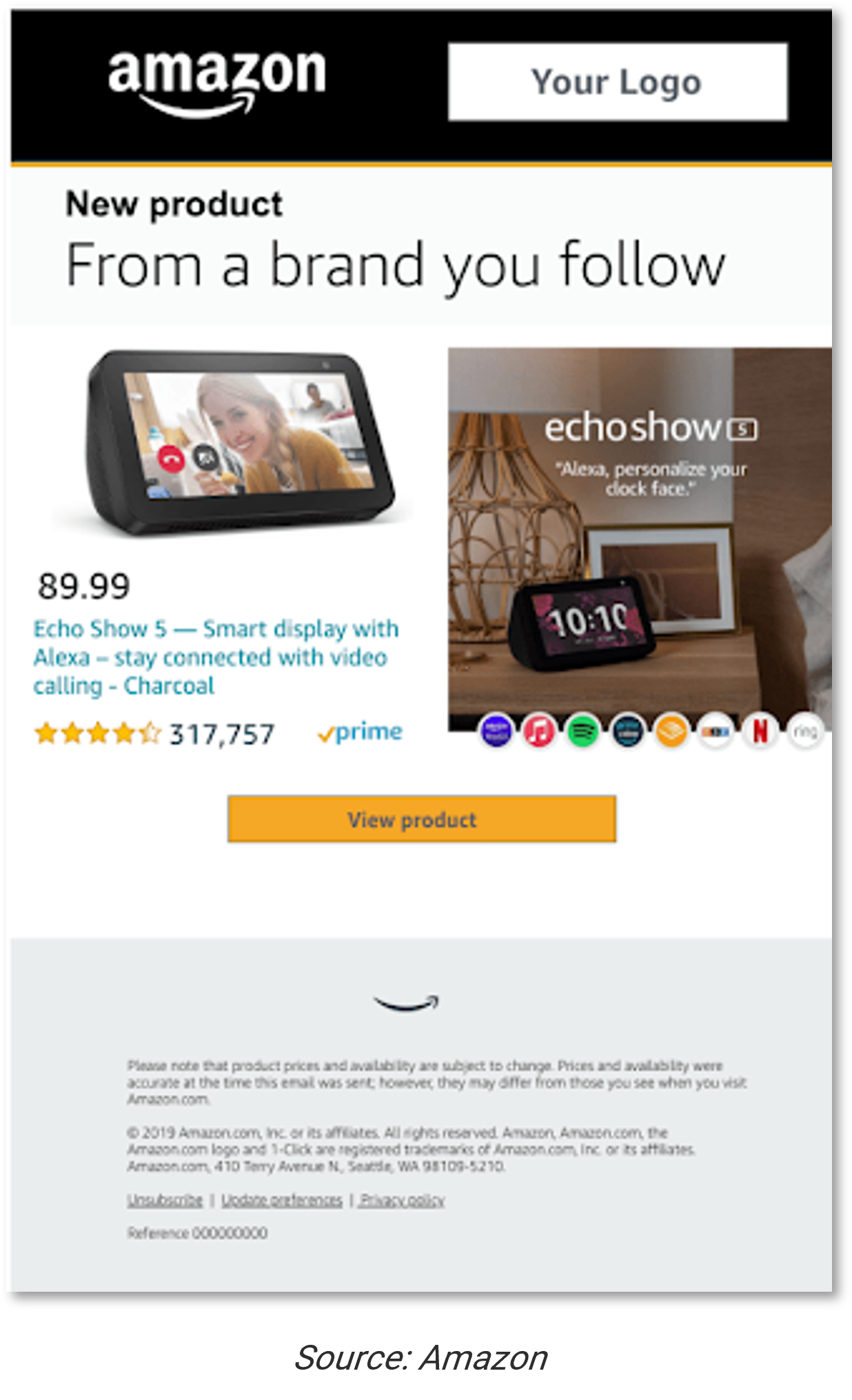

Our last formal benchmark on AMC suggested 59% were using the tool, primarily through their agency partners (60%+ of brands).

We believe adoption is higher today and will climb even further throughout 2024, although “using AMC” can be characterized as on a spectrum – from those that we would classify as “AMC-curious” to those running custom queries and actioning the insights in several ways throughout the Amazon business (and beyond).

This spectrum is also true for the agencies many brands are relying on, and thus it’s not enough to ask your agency partner if they’re “using AMC”. Drill deeper and determine how they’re using it (custom queries, for instance?), and importantly how the findings have altered their strategy for your or other accounts they manage.

We view AMC as a must-have capability for brands looking for a competitive edge on Amazon, and there’s room for further progress no matter where you are on the spectrum.

If you’re at ground zero today, get up to speed quickly (resources below can help) and dip that first toe in the water (or dive right in!). This can be through the increasing number of point and click type access points that more tool providers are offering.

If you’re already in the deep end, then you likely know there is still an ocean’s worth of insights and impact ahead of you – and continuing to get smarter and sophisticated with the tool will help you maintain your competitive edge as adoption moves mainstream.

Additional Resources on AMC:

- AMC 101

- 5 AMC Use Cases

- AMC Benchmark Research

- Tracking and Using New-to-Brand with AMC

- Measuring Customer Lifetime Value by Cohort via AMC

- Understanding DSP’s and Upper Funnel’s Impact on Search and Media Performance

Amazon-aware assortment and effective channel management: Critical, but easier said than done

Assortment and channel management continues to come up in our conversations with brands, particularly as Amazon remains focused on profitability. Non-strategic decisions in these areas can lead to meaningful net PPM challenges and tough conversations with your vendor manager. We expect these challenges to accelerate this year in CPG categories as promotional intensity picks up across the market.

Brands are commonly using the following assortment strategies to improve unit economics:

- National promos to avoid channel management issues

- Proactively taking down unprofitable items

- Multi-packs or bigger sizes

- Virtual bundles

- Attachments

Truly unique Amazon-exclusive assortment can provide the most impact in terms of minimizing price matching and improving net PPM, as well as driving incremental demand and competing more effectively with random factory brands. However, the resource-intensive product development process and minimum order quantities prevent many brands from pursuing this strategy.

Commitment Program a potential tool to improve forecasting and inventory availability

Accurate forecasts is a common challenge for brands which can get in the way of healthy in-stock rates – a high-impact lever on our Competitive Edge Diagram.

Amazon launched the Commitment Program to help solve for this. Under the program, brands receive a forecast with orders Amazon is “committing” to rather than using the typical P70 forecast based on customer demand, which can vary widely from Amazon’s actual orders.

Adoption is low for this newer program which is not available to all brands. Feedback has been mixed, with some brands reporting Amazon doesn’t end up ordering what was committed. While not a guaranteed high-impact lever, it’s worth discussing with your vendor manager and considering a test with the program if forecasting and in-stocks are significant challenges for your business.