April 5, 2023

Stratably hosted Kiri Masters & Julie Spear from Acadia to dive into the Amazon Factory Brand phenomenon and how incumbent brands can better compete with these unique rivals.

Watch The Recording Here

Competition is different on Amazon (and increasingly Walmart)

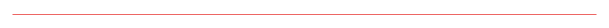

Stratably’s pre-event benchmarking revealed just how unique competing online can be.

Nearly half of registrants describe their competition on Amazon as “very different”, and another 38% see rivals a bit different than what they contend with inside of stores.

These dynamics appeared across a range of categories including toys, apparel, accessories, furniture, OTC vitamins, food, baby, home improvement and pet, to name a few.

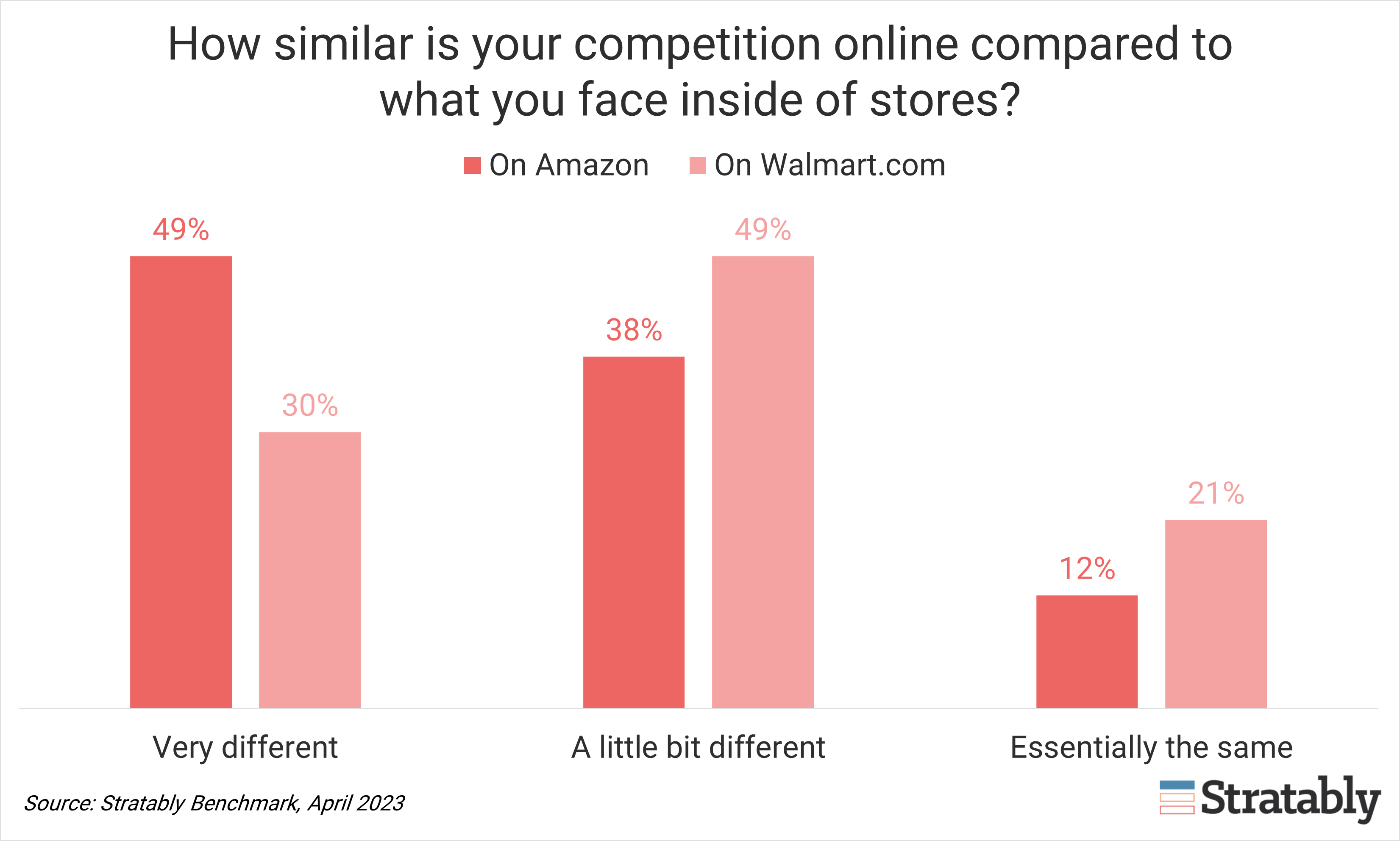

Interestingly, this dynamic of unique competition on Amazon is spreading to the other retail giant in the U.S., Walmart.

While not quite as extreme as Amazon, 79% of brands indicate their competition on Walmart.com is different than what they face inside of stores.

If Walmart’s management team is successful with its stated strategy of building a large marketplace business, we expect these figures will look even more similar in just a few years.

Asia-based factory brands are a significant driver to unique competition

One of the biggest drivers to unique competition on online marketplaces is the rise of “factory brands” on Amazon.

While it can be a bit difficult to define, factory brands can be thought of as companies that are selling inexpensive products that look very similar to well-established brands. We shared examples from women’s apparel, accessories, and sports and outdoor, to name a few, during the webinar.

These companies leverage the limited barriers to entry and inherent commodification of brands in order to carve out a meaningful portion of the market, challenging incumbents’ conventional ideas of what their brand is worth and who they are competing against.

Kiri & Julie walked through their research and experiences competing against these types of brands.

Here’s what we found most interesting from the live session:

- While U.S. based practitioners might feel these are “random factory brands”, the reality is that they have trademarks, logos, distribution channels, and access to all the same advertising and branding tools as incumbents. Further, they are specifically designed to win on Amazon’s marketplace with very specific ASINs they feel confident can win (vs. developing many ASINs to see what sticks), all of which combine to redefine our notion of a brand.

- Rather than unsustainable margins, these factory brands are more likely to simply have a different margin structure, and possibly lower margin hurdles. Since they’re not venture funded, they can’t afford to lose money, thus implying that despite their heavy investment into search, they are profitable.

- There are puts and takes to the longevity of this phenomenon. On the one hand, retailers are cracking down on black hat tactics around ratings and reviews which are believed to be a key way many factory brands carve out a position on the marketplace. But at the same time, ChatGPT will help these factory brands develop better content (language and cultural differences are often spotted in product descriptions) and it’s in the interest of Amazon and its peers to have these brands on their platform, reinforcing their role in the marketplace.

- Brands selling premium products should directly address inexpensive alternatives, highlighting the superiority of their product. Theragun is an example of a brand creating videos specifically comparing their premium-priced product to these types of competitors.

- Moving faster from a product innovation and securing standards and credentials can help demonstrate quality that factory brands have historically been unwilling or unable to invest in.

- Factory brands primarily focus on bottom of funnel paid search whereas incumbent brands are increasingly leveraging Amazon DSP to move up funnel. Developing more sophisticated ad targeting strategies (for instance, through the use of AMC) is seen as key to competing against these rivals.

- Incumbents should not dismiss this competition, but instead develop a clear understanding of share of voice and market share of sales. This can be enlightening for brands that feel they’re not really competing with these inexpensive alternatives and think the low price point or quality equates to a small business.

- Factory Brands appear most prevalent in the U.S. market on Amazon (compared to EU markets, for instance), largely just given the size of the market opportunity.

Watch The Recording Here