February 15, 2023

Stratably hosted Kiri Masters and Ross Walker from Acadia to explain the importance of Amazon’s New-to-Brand (NTB) metric.

Watch the session here

The purpose of New-to-Brand

NTB illustrates the degree to which your sales are being bought by consumers that haven’t purchased from a brand in the last 12 months.

It’s designed to illustrate how well you’re attracting new consumers to your products, thereby demonstrating a level of incrementality to a brand’s advertising efforts.

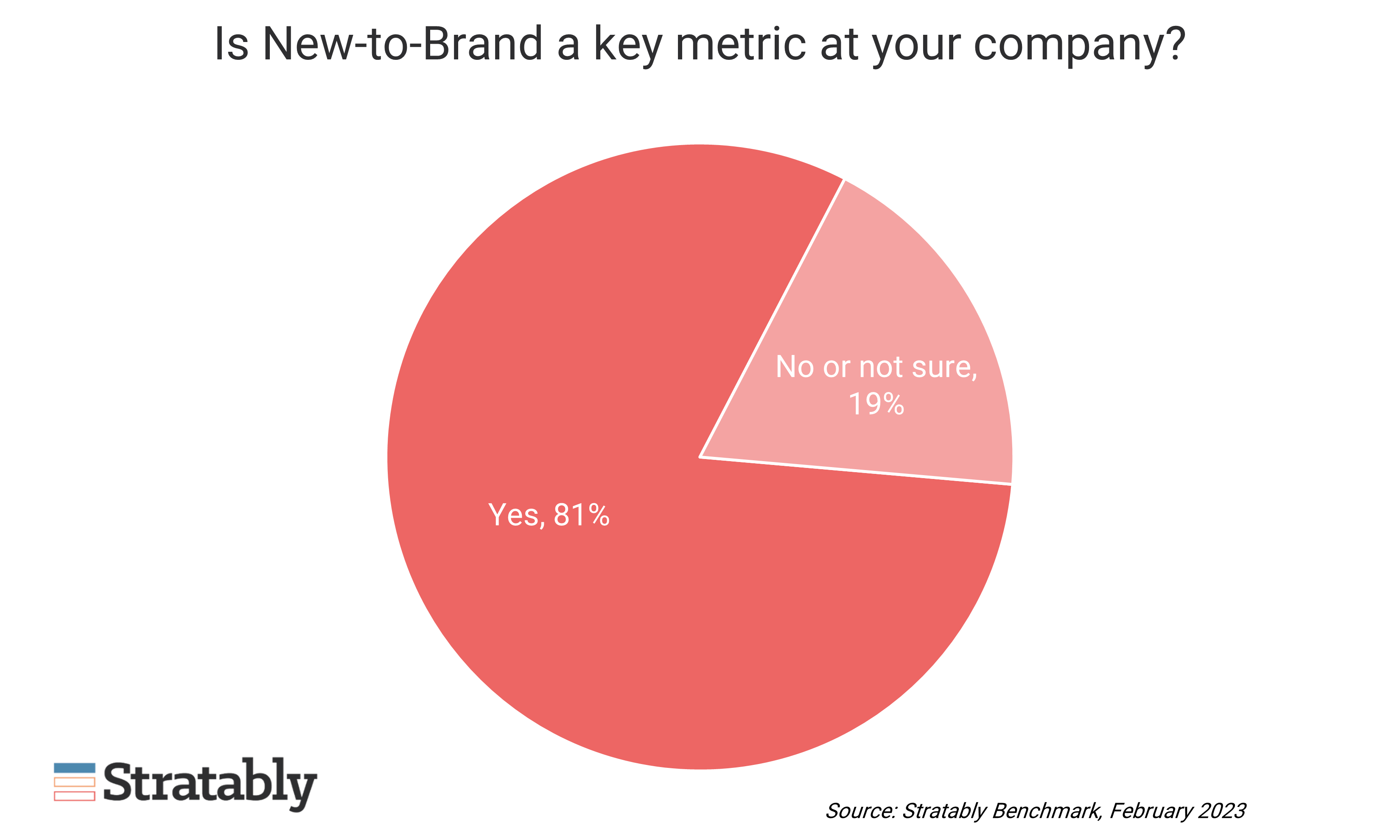

4 in 5 advertisers are using New-to-Brand in some way

81% of brands indicated NTB is a key metric at their company. This figure has grown over the last year as brands are increasingly interested in the incrementality of their advertising programs.

New-to-Brand can now be tracked from Sponsored Product ads

Originally, NTB was only able to be tracked from Sponsored Brands, Sponsored Display, and DSP, but not Sponsored Products (often 75%+ of a brand’s ad spend).

Sponsored Products can now be incorporated into this NTB metric via Amazon Marketing Cloud (AMC), creating a more robust view.

This is another example of Amazon’s efforts at continually adding more data and capabilities to AMC throughout 2023.

Here’s what we found most interesting from the live session:

- Brands must first determine their primary goal before deciding that NTB is the right metric. If they’re trying to drive profitability, then ROAS might be the better metric. However, if they’re trying to drive growth, then NTB is better because it illustrates how the brand is doing in attracting net new shoppers.

- It’s common to see NTB increase while ROAS decreases. This is because it’s more expensive to acquire a new shopper. Thus, it’s important to educate internal teams on what the goal is in order to set the right expectation around ROAS. A declining ROAS is not necessarily bad if incremental sales are increasing.

- Analyzing NTB performance can be done across ad units (i.e., which ad units are driving the most NTB) and/or across an assortment (i.e., which products are winning the most NTB shoppers). Advertisers can then shift spend towards the ad units and/or products that are having an outsized impact on NTB.

- AMC continues to add more data. NTB tied to Sponsored Products along with adding Sponsored Brands data into AMC were two examples shared. Additions of this nature are expected to continue in 2023 and beyond.

- Campaign structure and tags are very important to maximizing the potential of AMC.

- AMC does not track NTB for promotional activations like Deal of the Day. It is unclear if Amazon will be adding that capability this year.

Watch the session here