March 25, 2024

4 minute read

The following analysis compares recent performance across Amazon, Walmart, and Target, which together make up Stratably’s Mass Index.

Given their size, strategic importance to brands, and outperformance in the market, the performance analysis reveals who’s winning and losing and illuminates what’s driving success in retail today and what we can expect in the year ahead.

Let’s dive in.

Key Takeaways

- Stratably’s Mass Index is growing at ~2x the rate of the broader U.S. retail market. Amazon and Walmart led the outperformance given clear alignment to today’s value-conscious consumer.

- Discretionary categories remain challenged for Walmart and Target but are seeing sequential improvement, while Amazon continues to thrive in these categories.

- Store-based fulfillment models are driving eCommerce growth for the omnichannel retailers.

- The Mass Index is forecasted to grow +6.8% in 2024 compared to 2.9% for the U.S. retail market.

Amazon and Walmart outperformed the market as they align with consumers’ value-conscious shopping behavior.

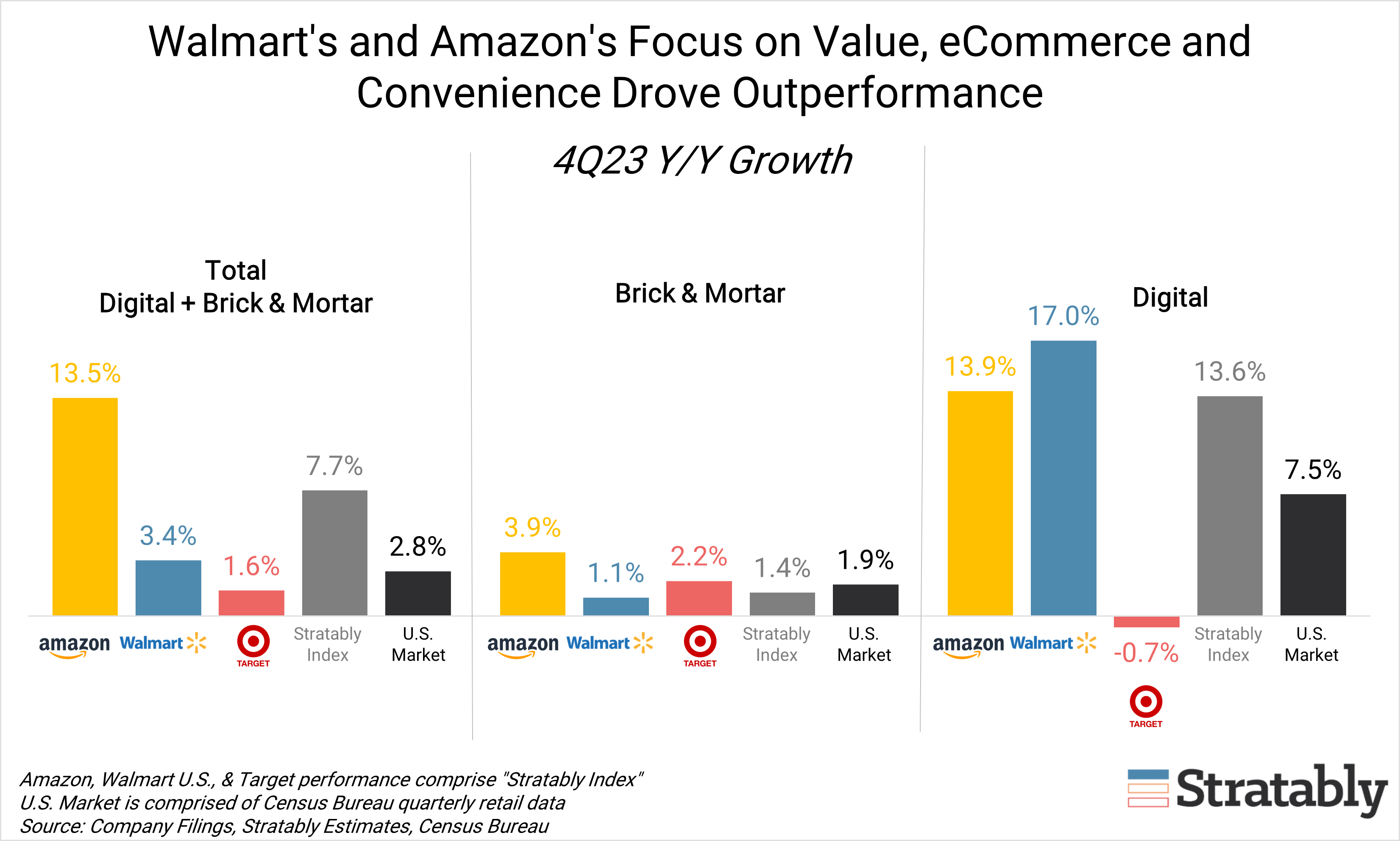

Stratably’s Mass Index – comprised of Amazon, Walmart, and Target – grew total U.S. retail sales +6.0% in 4Q23, ~2x the rate of the broader U.S. retail market, as estimated by the U.S. Census Bureau.

What’s driving the outperformance? In short, it’s due to Amazon’s and Walmart’s alignment to value for today’s price-conscious consumer as well as Amazon’s dominance of the eCommerce channel (and to a lesser degree, Walmart), which is contributing roughly half of the incremental dollar growth in the market.

Amazon carried the weight with another quarter of double-digit growth (+13.5%) as its value proposition of price, speed, and selection resonates with consumers – particularly price in today’s challenged economic environment. The growth is particularly notable given its heavy exposure to general merchandise categories, which is significantly outperforming other retailers considering Walmart and Target are seeing year-on-year declines in that category.

Walmart outperformed the market by a narrower margin at +3.4% for its total U.S. business. Its EDLP strategy is a key driver of the performance, with management noting share gains among upper income households and consumers responding well to its expanded rollbacks.

The index was partially offset by Target’s underperformance relative to the market, growing total sales +1.6%. Given its heavier exposure to discretionary categories like apparel and home compared to Walmart, Target has experienced greater pressure from challenged disposable income in the last several quarters. However, its 4Q results were an improvement for the second quarter in a row given moderating pressures in these categories.

Digital outshined B&M in 4Q, driven by store-based fulfillment options.

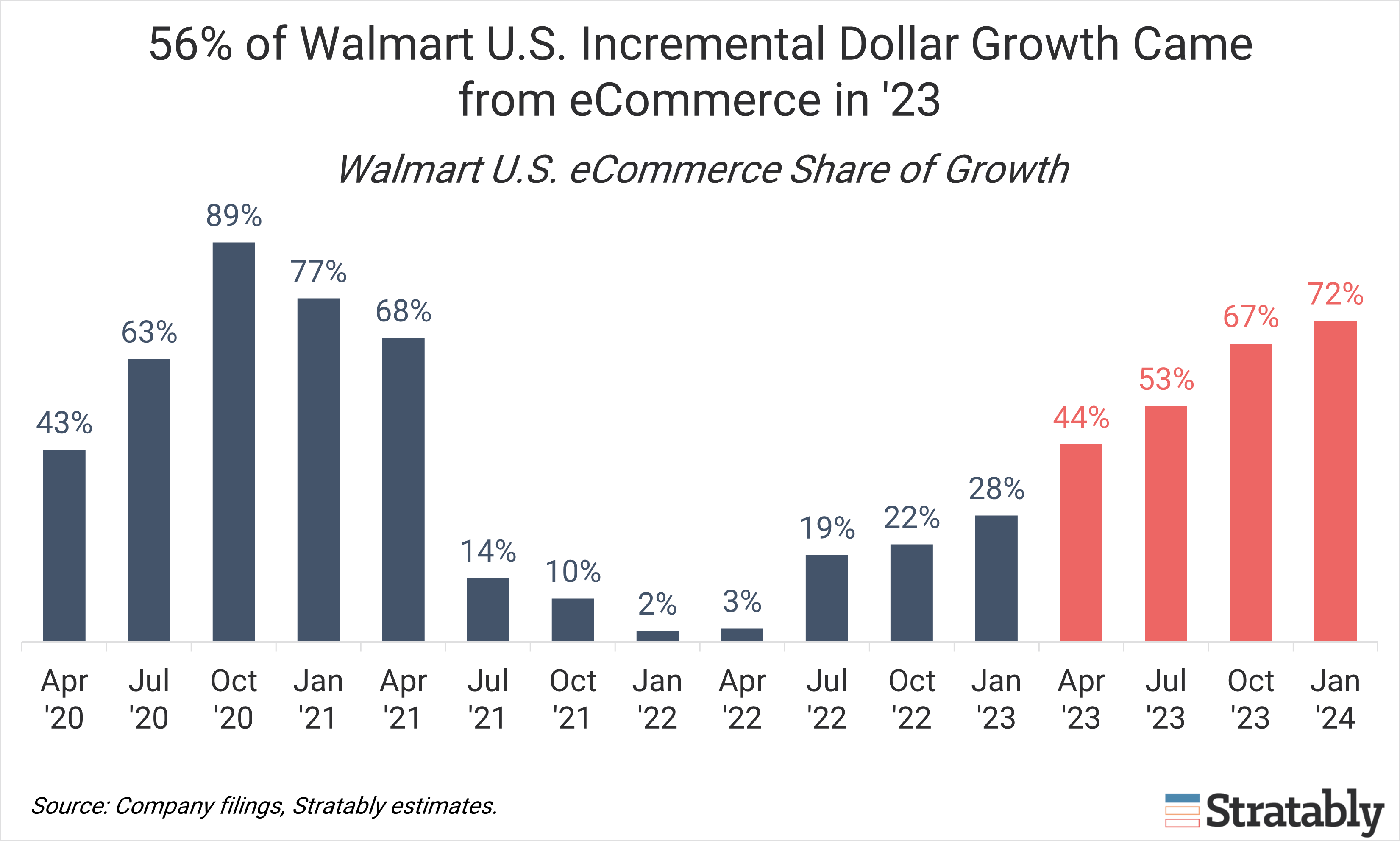

While Walmart’s stores business remains healthy (with comps in the mid-single-digit range), growth of the digital business is far outpacing it at +17% in its latest quarter.

This translates to eCommerce accounting for a whopping 72% of incremental growth in 4Q (!) and 56% for the full year.

Target’s digital business declined -0.7% in 4Q, although that represents a sequential improvement (down -6.0% in 3Q) and outperformed the stores business which posted comps of down -5.4%.

For both Walmart and Target, store-based fulfillment models are fueling its eCommerce growth as they aim to use stores as an asset to provide consumers the convenience they want out of eCommerce, while managing the economics of digital.

Walmart reported store-fulfilled delivery was up nearly 50% and was the main driver of new Walmart+ memberships and share gains in upper income households. We expect the lion’s share of eCommerce sales to continue to come from its pickup and store-fulfilled delivery options in the near and medium term.

Target noted strength in its same-day fulfillment options with Drive-Up growing in the double-digits. The company is doubling down on store-based fulfillment with its announcement of Target Circle 360, a paid membership option for unlimited same-day delivery (via Shipt which fulfills from its stores) at an introductory price of $49 per year.

2024 forecasts suggest a continuation of recent trends.

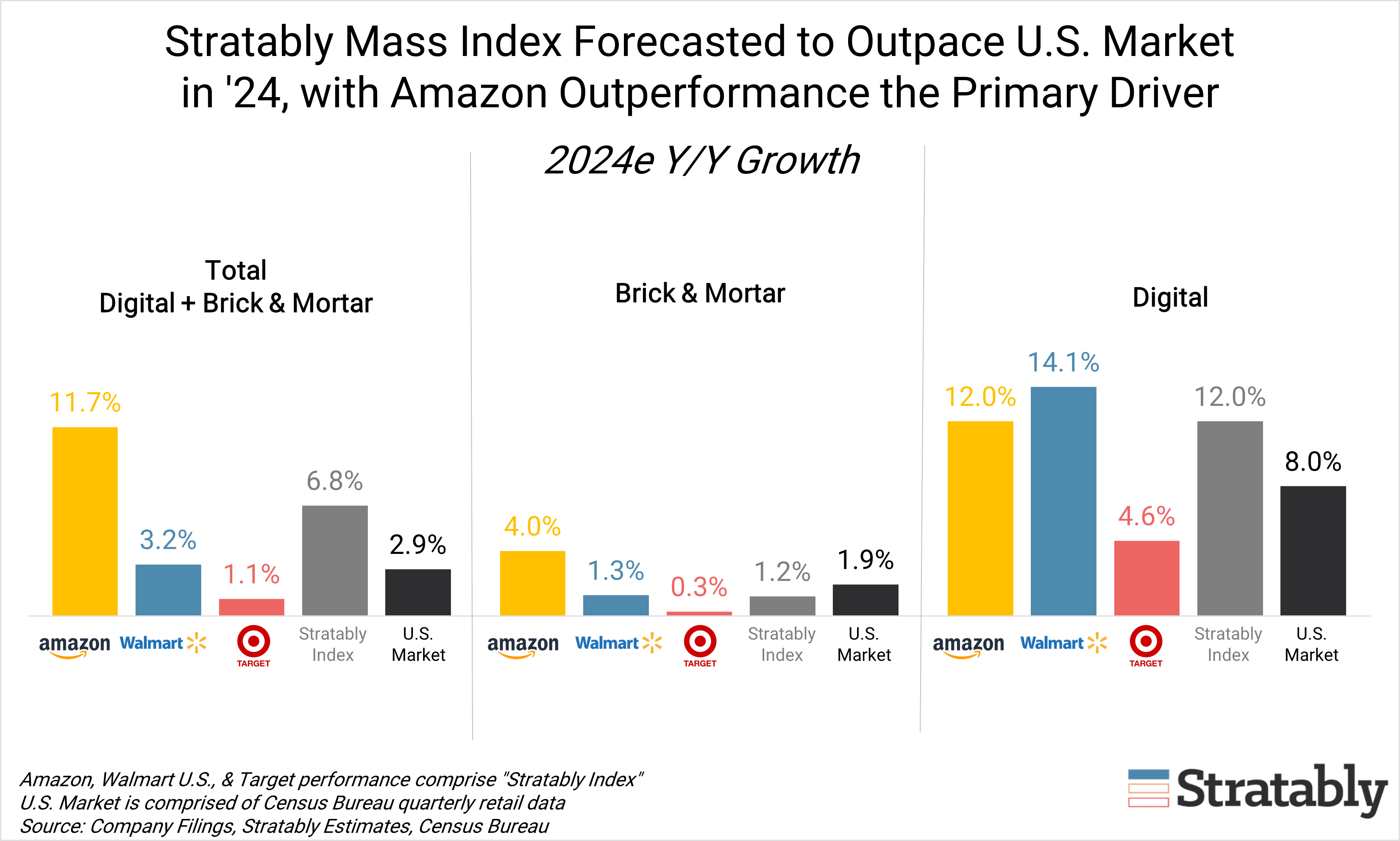

We expect the value-focused nature of consumers to continue through the year and therefore expect a competitive retail environment to be driven by price, promotions, innovation and overall value.

Accordingly, the Mass Index is forecasted to grow 6.8% in 2024 with a breakout that looks similar to 4Q23:

- Digital outpacing B&M

- Amazon > Walmart > Target

- Stratably Mass Index > U.S. market (+2.9%), led by Amazon’s strength

For digital leaders, winning with these key retailers and resonating with the consumer in ’24 will require:

- Value: Providing value via competitive pricing (price increases less likely this year), promotions, and/or compelling innovation.

- Visibility: Staying visible and competitive on the digital shelf with healthy retail media spend (most growing budgets by 50-100 bps as a percentage of sales) that drives consumers to PDPs that convert.

- Marketplace Control: For Amazon (and to a lesser degree, Walmart), competition is particularly fierce thanks to the fast-growing third-party marketplace, in many cases requiring even more aggressive retail media spend. Understand your competition and market share dynamics as a key input to budgeting, and maintain control of your own brand on the marketplace through fundamental eControl practices.

- In-Store Distribution: For Walmart and Target, stores are the gateway to eCommerce growth, with in-store distribution and availability a key lever. Ensure your digital strategy is tightly integrated with your B&M efforts to drive the omnichannel business.