10-minute read

TL;DR: AMC is a marketer’s secret weapon, helping them understand the roll Amazon can play from a customer acquisition and media channel perspective. It is under-adopted because it’s a complex analytical tool, that has been poorly marketed, and its name means people categorize it as relevant only for the Amazon business. However, early adopters will have an advantage over rivals as the industry faces rising CPCs, difficulty targeting consumers, and uncertainty around an increasingly complex path to purchase.

Amazon Marketing Cloud

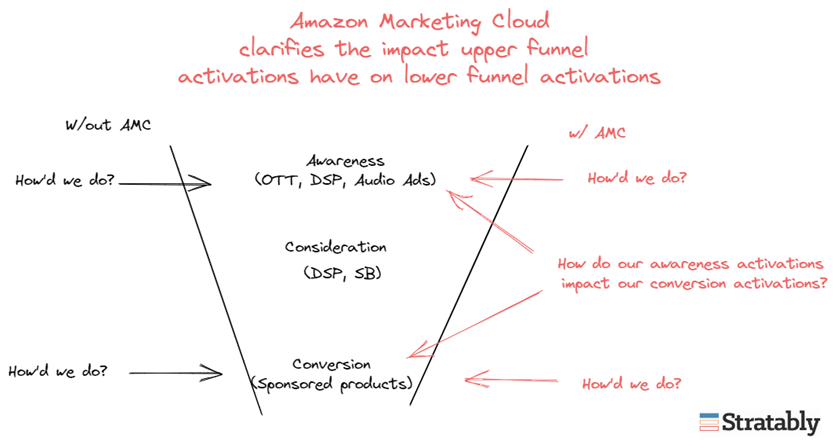

Amazon Marketing Cloud (AMC) is an under-adopted analytics option that answers challenging questions like how upper funnel and lower funnel activations work together to grow sales.

The goal with this article is to highlight why the tool is impactful for those selling on Amazon or DTC, challenge conventional thinking about the tool, and ultimately prompt discussion internally and with agency partners so that you start taking advantage of it.

Stay till the end for help on applying the analysis to your business!

The insights below come from talking with practioner friends and scouring the web for everything I could find on AMC.

Before we get going…

I’m an independent analyst. I have no incentive to highlight AMC other than purely because I think it’s an under-adopted tool you should pay attention to.

- I don’t work for Amazon or an agency that wants to sell its services related to AMC and this is not a sponsored post.

- There are alternative clean room options from companies like Google, but AMC is uniquely relevant to digital leaders doing business on Amazon.

- Proceed knowing this is my take, pure and simple!

The Opportunity:

While the free, highly customizable AMC tool has been available for some time, it remains under-adopted in the brand community.

In addition, because it’s an “Amazon” tool, too few of brands are thinking about it as a way to answer deep and meaningful questions that go beyond the Amazon business.

Questions like the ones I’ve been talking about with Chief Digital Officers over the last month…

- How do we maximize our ad dollars in a time of rising competition on Amazon?

- How do I integrate retail media into our broader consideration set?

- What role does Amazon play in our corporate strategy?

- What role can Amazon media play for our DTC business?

- Does brand building even matter anymore?

- How do we measure upper funnel activations better?

Amazon defines AMC as…

- “Amazon Marketing Cloud is a secure, privacy-safe, and dedicated cloud-based environment in which advertisers can easily perform analytics across multiple, pseudonymized data sets to generate aggregated reports. Inputs can include an advertiser’s own data sets, as well as their Amazon Ads campaign events, such as impressions, clicks, and conversions. AMC reports can help with campaign measurement, audience refinement, supply optimization, and more, enabling advertisers to make more informed decisions about their cross-channel marketing investments.”

- Stratably translation: AMC is an analytics offering that allows you to answer a range of questions around how your consumers are finding and buying your products, with the most common use cases centered around optimizing Amazon ad spend across the funnel.

In particular, AMC sticks out because...

- It allows you to understand how upper funnel media impacts lower funnel media effectiveness.

- This enables you to develop more effective strategies across the funnel, which is especially important in a rising CPC, margin-pressured environment.

- This moves the analysis beyond last touch attribution, making it more aligned to the reality that a consumer engages in a variety of elements before ultimately searching on Amazon and converting via a sponsored product click.

This is what prompted the idea that AMC is a marketer's secret weapon. It helps them understand the joint impact of its advertising activations rather than discrete analyses at isolated points in time.

For the pictorially inclined, this is how I picture one of the more powerful use cases for AMC:

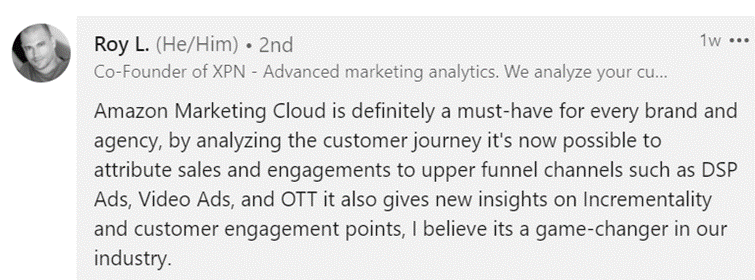

I'm not the only one excited:

Patrick Miller describes it as a phenomenal tool… “It’s awesome because…the ability to upload brand first party data and combine that with amazon data to see what the relationships look like, such as audience overlap, cross platform media, and gain insights around what tactics and campaigns drive the business” (minute 8:30)

And comments like this are growing more common across social channels:

Big picture use cases quoted from Amazon:

- “Amazon advertisers can use Amazon Attribution to measure the on-Amazon impact of their non-Amazon media.”

- “They can also measure brand preference, awareness, and brand lift of their Amazon Ads campaigns through leading industry measurement partners.”

- “Amazon Marketing Cloud brings advertisers additional flexibility to understand the sequence of marketing touchpoints that deliver impact and build a comprehensive view of how to most effectively engage their audience.”

Specific use cases from around the web (this is just a sample as the AMC capability is extremely customizable):

- Fractional attribution analysis (This is one of the biggest use cases for AMC as immediately changes the understood value of both DSP and Sponsored Products)

- Flywheel determined 20% of Sponsored Products clicks come after a DSP view and purchase rates increased by 4% when that occurs. (this comes from WARC’s great report around “rethinking brand”)

- Flexispot, working with 4KMiles, determined that audience purchase rate increased 18.9x when exposed to multiple touchpoints versus only seeing a sponsored product.

- Use cases from Pacvue:

- Assisted Conversion Analysis: first look beyond last touch attribution to gain insights into the importance of reaching the consumer at multiple stages of their shopping journey.

- Overlap Report: validate the efficacy of a full-funnel approach with visibility into how paid search and display ad types work together to move the consumer from consideration to purchase.

- Amazon ad impact on DTC (So it’s not just Amazon sales that can be analyzed…this is where 1P data is used)

- “A financial services company built an AMC model that reports on how each element of their Amazon Ads investment contributes to conversion events on the brand’s own website.” - Amazon

- Optimize intra-day bidding (limited budgets and higher competition mean you need more strategy refinement)

- According to Patrick Miller at Ascential, they are using AMC to inform autonomous bidding they place throughout the day, bidding higher at certain times and lower at others depending on auction dynamics and shopper behavior.

- Flexispot worked with 4KMiles on AMC to uncover that conversions were highest in the afternoon, enabling them to implement intraday bidding to the most efficient part of the day.

- Influencing in-store Whole Foods & Fresh (imagine the power of this if Amazon Fresh had 500 stores rather than 25!)

- AMC enables a brand that sells in Whole Foods or Fresh Stores to see how their physical store sales are influenced by Amazon media campaigns.

- Tinuiti has studied the top geographic markets for acquiring Amazon Fresh customers

- New to Brand

- Tinuiti has studied which gateway ASINs for its clients are most effective at capturing “New to Brand” customers.

- Users can also now get data on new-to-brand customers from Sponsored Product Ads (previously could only see new to brand from Sponsored Brands and Display)

Usability is improving:

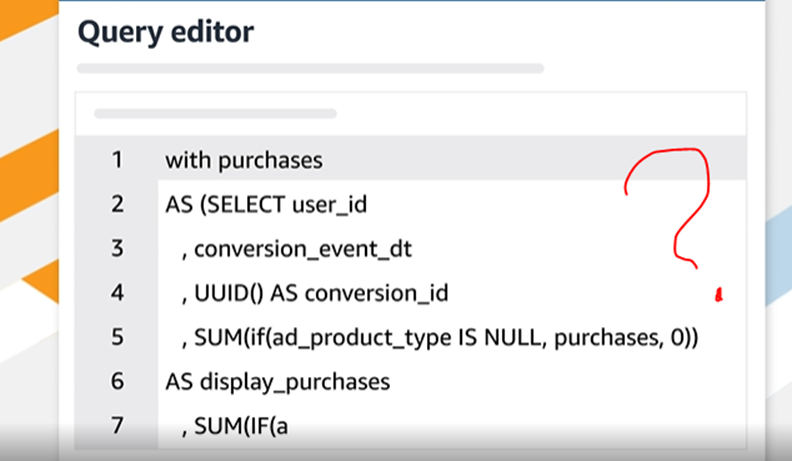

One of the limitations with AMC has been the complexity of using it.

For instance… ????????????

However, agencies using AMC are increasingly creating standard reports that can more easily be tapped into.

For instance, Pacvue and Perpetua have both done this (probably others too, but these are the two I came across).

This is an easier way to start testing AMC insights and get the analytical juices flowing around additional questions that AMC can answer.

Privacy Compliant:

The world appears to be moving in only one direction, which is more privacy protections for consumers.

AMC was built with privacy compliance in mind:

- Each instance is dedicated to an AWS account

- Accepts only pseudonymized information

- Advertisers receive aggregated, anonymous outputs rather than being able to export datasets

- The system returns null results if a query violates privacy considerations

Why is AMC under-adopted?

Because it’s a complex analytical tool, that has been poorly marketed, and its name means people categorize it as relevant only for the Amazon business.

However, every retail media leader and digital marketer inside a consumer brand should be using AMC today.

The insights that can be gleaned on the impact of upper funnel activations on lower funnel efficiency can be applied to other retail media offerings. For instance, if our upper funnel efforts on Amazon drove 5% purchase rate improvement on Amazon, what does that mean for our upper funnel efforts on Kroger or Target?

Further, the roll of Amazon media in driving DTC sales can be compared to performance from programmatic offerings or paid social activations for your organization. In other words, AMC is a catalyst to incorporating Amazon media (and therefore retail media more broadly) into the broader marketing set.

Said plainly, AMC is relevant for the entire business. Amazon executives should market this reality more to drive adoption, and then continually refine the tool to reduce complexity.

Retail media "market" implications: ????

Retail media networks have exploded in popularity. One of the ways these networks will compete is by improving attribution tools to demonstrate how they can grow advertisers’ businesses better than rival networks.

AMC is incredibly impactful in this regard, strengthening Amazon’s formidable advertising business. This type of innovation is why Amazon’s ad business is 15x its next largest retail media peer.

It’s what every retail media rival needs to be building or enabling to stay competitive with Amazon.

Let’s apply this to your business…answer the following questions:

- Have we briefed our CMO on AMC?

- Does our DTC team know about AMC?

- How have we adjusted our media and/or paid search campaigns as a result of AMC findings?

- How have we adjusted our intraday bidding strategies as a result of AMC?

- How have we shifted our promotional strategies across assortment to increase new to brand based on AMC findings?

- How are we using insights from AMC to inform our Amazon advertising strategies to grow our DTC business?

Related Reading:

- Benchmark Research on Amazon Marketing Cloud, Attribution, & Stream – Part 1

- Benchmark Research on Amazon Marketing Cloud – Part 2

- Benchmark Research on Amazon Attribution – Part 3

- Benchmark Research on Amazon Stream – Part 4

- Benchmark Research on Analytics Teams – Part 5

![]()