February 9, 2023

Stratably hosted Mark Stamps from Harvest Group to explain the programmatic opportunity via Walmart Connect and Target Roundel, and how that flows through to the P&L and joint business planning.

Watch the session here

We're in the early innings on adoption

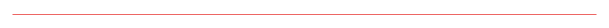

58% of webinar registrants report they are currently activating programmatic via Walmart and Target today. When compared to the 93% using Amazon’s DSP, the figure indicates we are still in the early innings of more widespread adoption.

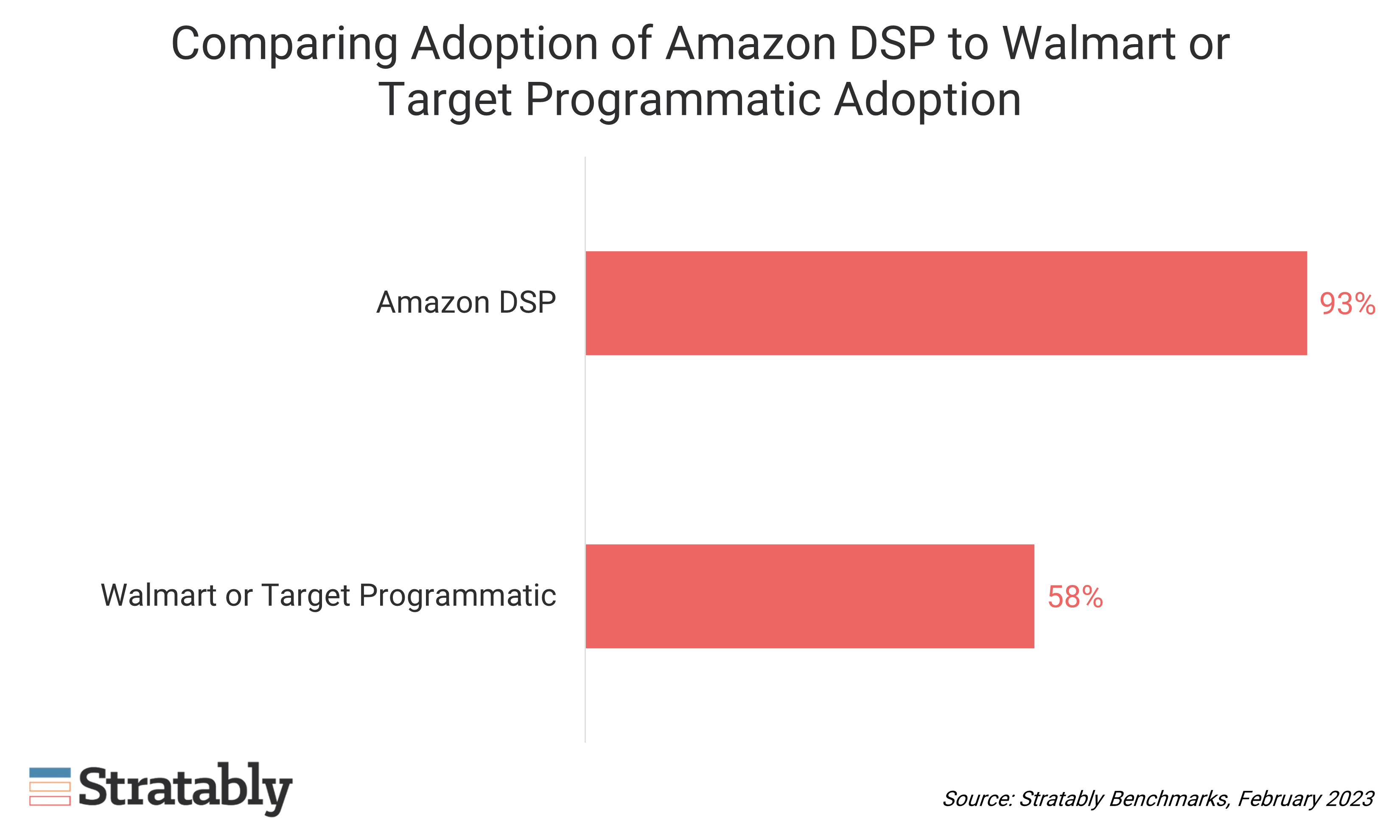

Part of the challenge Walmart and Target face is the perception of the costliness of their offering. More than half of those using programmatic on Walmart or Target estimate it is more costly than alternative programmatic options.

Potential for better targeting and measurement, plus a financial incentive

Many brands are spending dollars on programmatic today, often via an agency that is working with The Trade Desk or another platform.

During the session, we learned brands can access the same inventory via Walmart and Target. The value proposition includes access to retailers’ data to build audiences, closed loop measurement across delivery, pick-up and in-store, and a P&L credit. This means the potential for…

- Better targeting

- Improved measurement

- A financial incentive over traditional programmatic

Both Walmart and Target will charge brands for these programmatic advantages, and it remains unclear how the additional cost compares to the benefits. However, the financial incentive should fundamentally change the calculus inside of brands on how they evaluate their programmatic strategy.

Here’s what we found most interesting from the live session:

- The unbundling of onsite (typically lower returning) from offsite will help drive more dollars towards Walmart Connect and Target Roundel

- Retailers will increasingly seek these funds especially if they identify brands are spending on programmatic activations through other access points

- The degree of integration between merchants and the ad team varies, although this is expected to improve this year.

- Programmatic spend doesn’t necessarily roll into a scorecard merchants manage to, but this spend is important at the divisional level.

- 60-70% of Walmart’s transactions are believed to be traceable, and the percentages for Target are likely higher – this is helping with closed loop reporting that is showing a large impact of ads on in-store shopping.

- The closed loop reporting attribution seems very positive; most brands will consider these numbers in the context of knowing the absolute accuracy is still a work in progress.

- Walmart is planning to release its new-to-brand metric more widely

- Reconciliation will prove challenging for brands as the exact “credit” they receive for the spend is not expected to be easily discernable.

Two big questions consumer brands will try to answer as programmatic ramps up at Walmart and Target.

- The first is how their programmatic offering compares to alternatives. This is a difficult question to answer due to the opaque nature of programmatic.

- Secondly, programmatic budget and execution tend to happen outside of Walmart and Target teams. Thus, brands will be challenged organizationally to bring retail media programmatic into the broader consideration set.

Watch the session here