April 9, 2024

3 minute read

Today we answer four common questions on Luminate, Walmart’s analytics offering that:

- Is gaining adoption among merchants and brands

- Is expected to replace Decision Support System (DSS) this year

- Offers the most sophisticated and data-driven brands a competitive edge on Walmart

Let’s dive in.

Key Takeaways

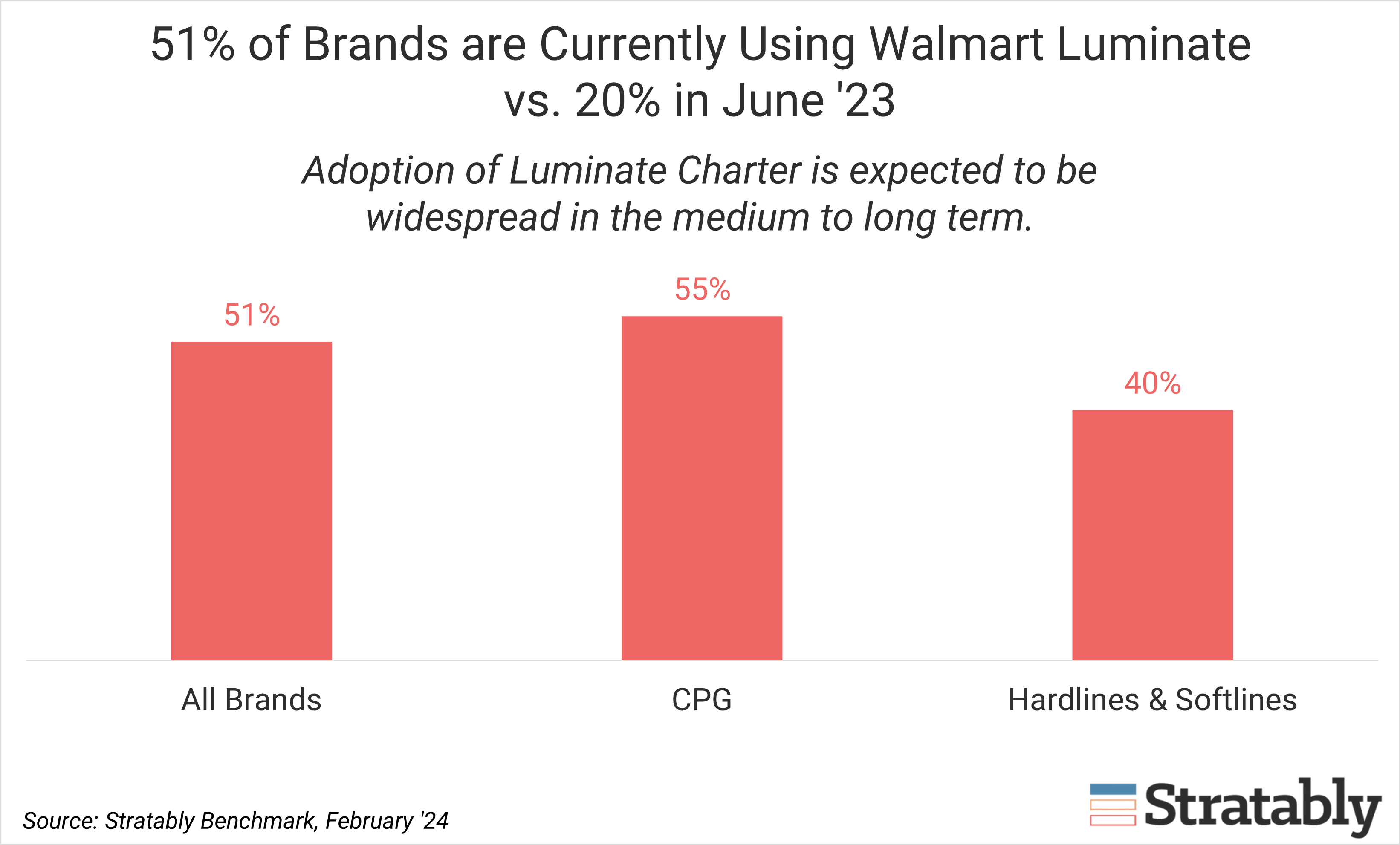

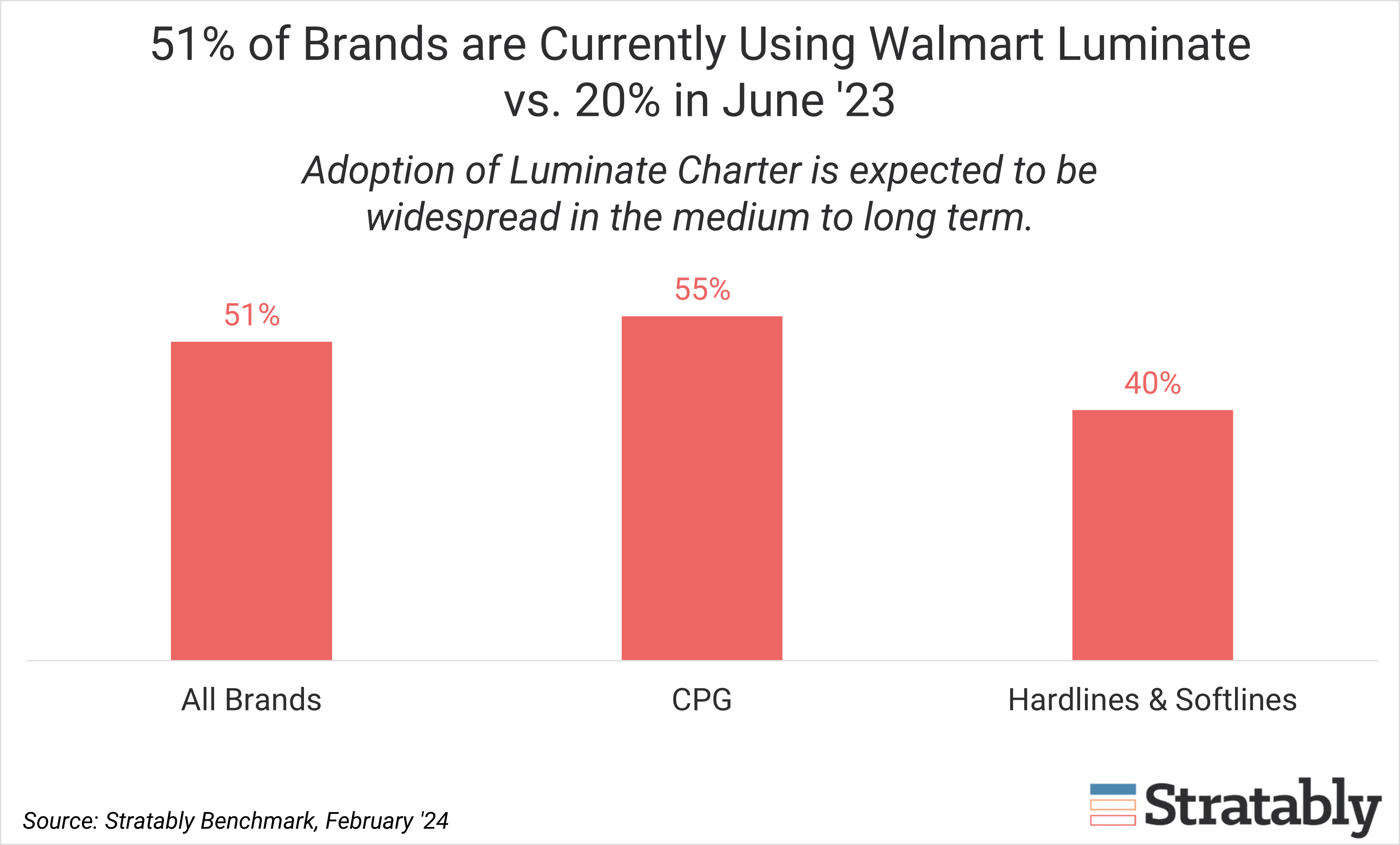

- Luminate adoption sits at 51% today (either the free Basic version or paid Charter), slightly higher in CPG categories. We expect Charter will become a standard cost of doing business with Walmart over the medium to long term.

- Funding is most commonly coming from corporate budgets. Trade spend budgets are unlikely to be sufficient for Luminate without tough trade-offs elsewhere.

- Read on for 7 ways brands are using the data today, including in your Walmart Connect strategies, internal investment planning, line reviews, and more.

Are my peers using Luminate?

According to our benchmarking, 51% of brands are using Luminate today (either the free Basic version or paid Charter). Adoption is higher among CPG brands than hardlines and softlines.

This compares to just 20% adoption less than one year ago.

Our broader research suggests investment into Charter is largely due to merchants’ asks rather than brands’ voluntary interest in the insights. Thus, adoption is higher for larger companies and especially those in advisorship roles (more or less required to maintain advisorship).

Brands without a strong ask from their merchant on Luminate feel less urgency to invest at this time, although pressure is increasing with most merchants. We expect Charter will become a standard cost of doing business with Walmart over the next 12 to 24 months.

Are merchants using Luminate?

Merchants are at varying points along the spectrum in terms of adopting Luminate (hence brands feeling varying degrees of pressure from them).

However, merchants are increasingly being pressed to adopt Luminate insights in the management of their categories and will increasingly rely on the Merchants Insights Decision Matrix and Composite Scores. Brands will more or less need to invest in Luminate Charter to have visibility to the reports that matter in the Decision Matrix and the Composite Scores (more info here).

What can I do with the data?

Luminate participants report some interesting insights and early wins coming from the data, although the impact thus far hasn’t offered a significant ROI given the high price tag.

Working with the data can be cumbersome and there is limited integration today with other platforms like Walmart Connect (WMC) and data partners. Deeper utilization likely increases as capabilities improve over time.

Despite a seamless connection to WMC, much of the data can be used to make your advertising dollars more effective and efficient. Brands are leveraging these insights on their own and/or having their Walmart Connect reps tap into their Luminate data.

Our benchmarking shows Luminate users enjoy stronger WMC performance relative to their expectations and are more likely to be increasing their WMC spend as a percentage of sales in ’24.

7 Ways Brands are Already Using the Data:

- Align WMC spend to more loyal and profitable customer cohorts

- Use nil picks data to more quickly remedy potential inventory issues

- Leverage insights in the sales story to merchants to help unlock distribution

- Track penetration and market share metrics to understand impact of WMC spend

- Leverage insights within shopper data to increase household penetration and baskets

- Use Customer Perception tool to inform product innovation (for Walmart and beyond)

- Quantify digital’s contribution to incremental dollar growth to unlock greater investment

How should I fund the investment?

Current Charter users are almost always funding the investment with corporate budgets. Brands that fund (or would fund) out of customer trade spend are either not able to justify the investment or are having to cut elsewhere (typically WMC).

When evaluating the investment, don’t forget you’ll need internal headcount to analyze the data and potentially an added investment to access the data via a third-party API partner.

Related Reading on Walmart

- Walmart margin, Connect, and Luminate asks are challenging brands’ P&Ls

- Benchmarking on Walmart Connect performance and investment levels

- Walmart Luminate and Connect – updates and best practices

- Benchmarking on recent Walmart sales performance

- How Walmart stacks up to the market

- Analyzing Walmart’s 4Q23 results