January 8, 2024

We recently benchmarked brands to better understand their sales performance, retail media performance, and 2024 investment plans with Target.

In this concise report, we share the detailed data points for you to benchmark against your own business, as well as perspective on brands’ retail media investment criteria that is driving Target (and other large, strategically important retailers) to receive more dollars this year.

Let’s dive in.

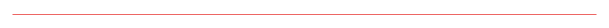

Ad performance came in worse than expected for a net 28% of brands in ‘23

Last year, retail media spend with Target performed worse than expected for 36% of brands compared to positive performance versus expectations for 9% of brands and 23% reporting in-line performance.

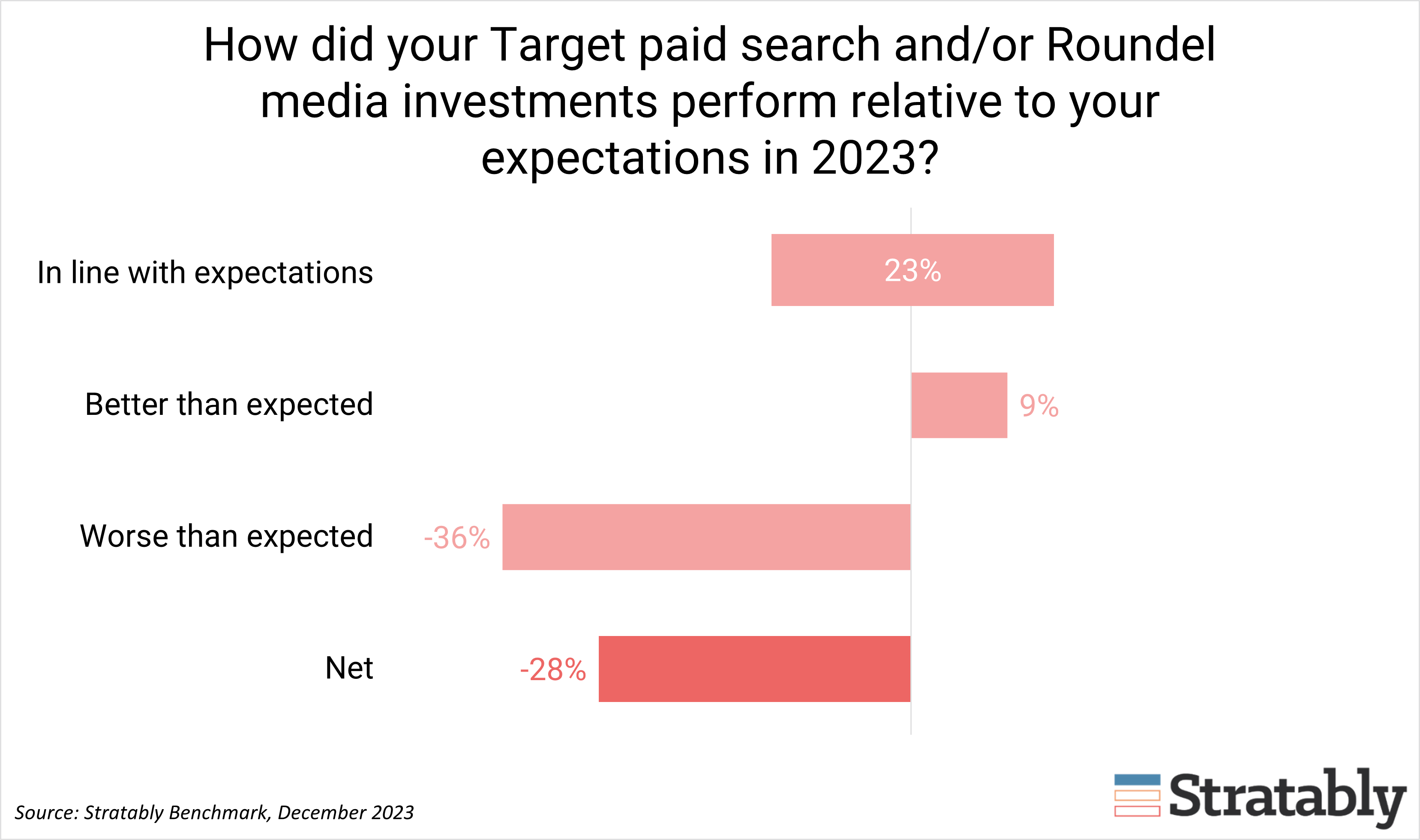

The underperformance for a net 28% of brands is at least partially due to sales softness as a net 17% of brands reported worse sales performance versus expectations in 2023.

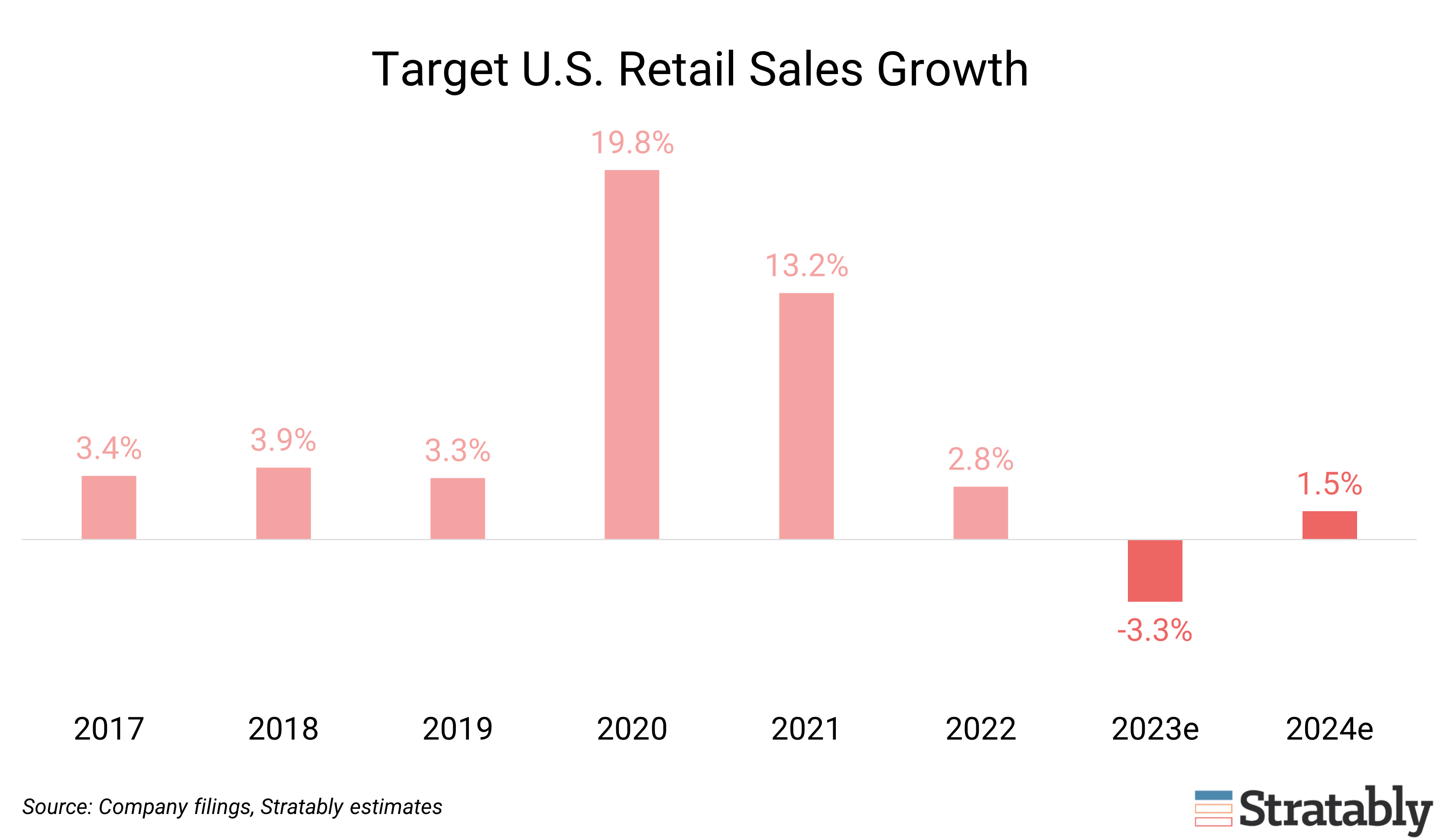

We forecast Target’s total U.S. retail sales were down 3.3% last year with digital down 6.4%, driven by consumers’ heightened focus on value and a shift away from discretionary categories, where Target is heavily exposed.

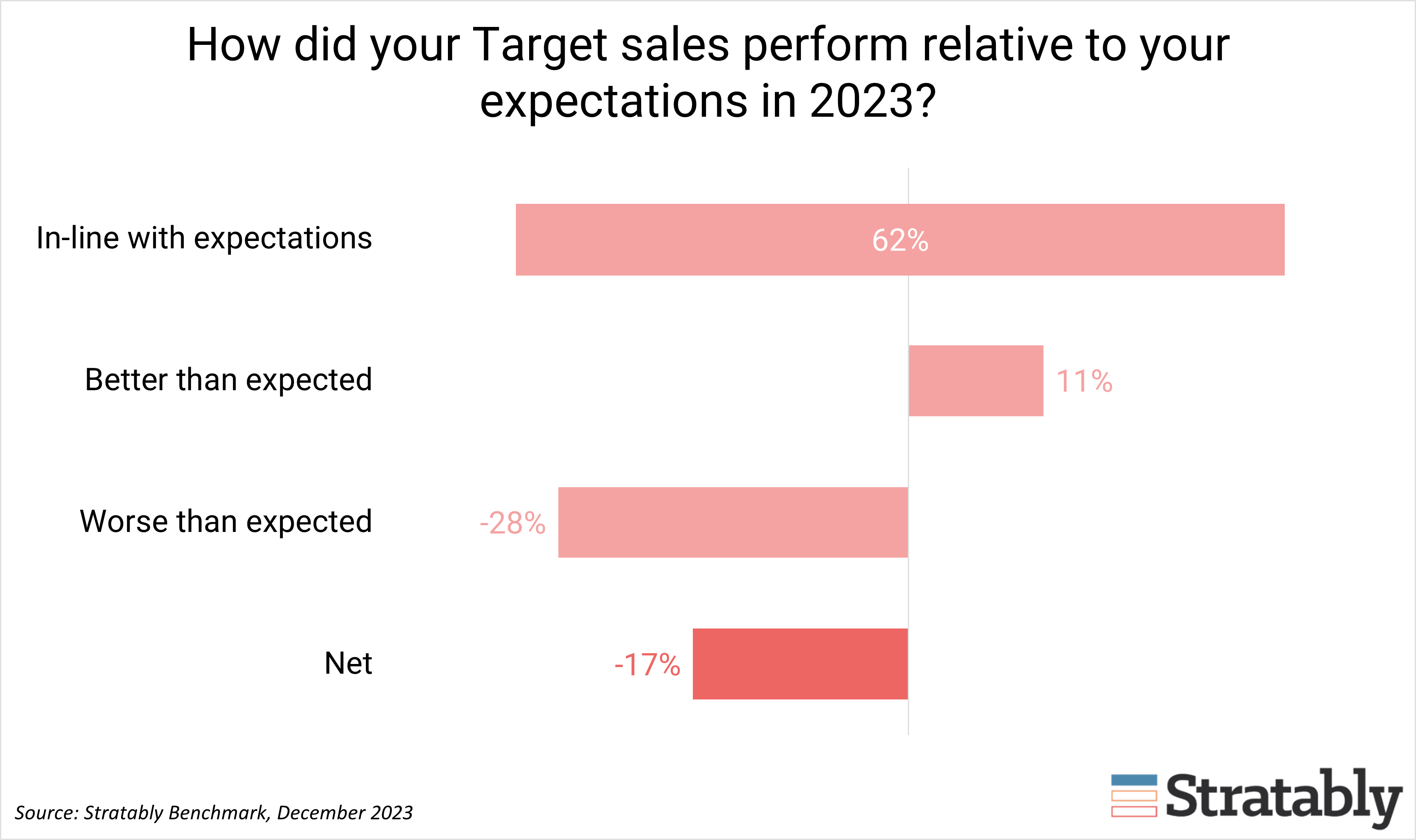

Yet, a net 13% plan to increase investments in 2024

Despite challenging sales and ad performance in 2023, 26% of brands plan to invest more into Target’s retail media options as a percentage of their Target sales compared to 13% of brands planning to invest less and 36% planning no change.

There are two reasons driving the increased budgets:

1 – Brands expect sales performance to recover this year.

Ad performance likely improves alongside a rebound in sales growth after a down year. We’re forecasting Target’s 2024 total U.S. retail sales to grow 1-2%, with digital growing high single digits.

2 – Target remains a strategically-important omnichannel account.

Our research suggests overall strategic importance and in-store impact are key considerations in allocating retail media budgets in addition to pure ad performance and other factors like reach, advertising capabilities, and reporting capabilities.

Strategic importance has kept retail media dollars concentrated with the largest retailers like Target, Amazon, and Walmart (and Kroger and Instacart for CPGs). Thus, even if brands saw relatively weak performance last year with Target, it remains an important account they plan on supporting with greater investment in 2024.

More on Target and Retail Media Investment Decisions:

- Target and Roundel

- Retail Media Investment Decisions

- And even more in the Knowledge Hub!