July 18, 2024

6 minute read

Around every AVN season, there’s a corner of the 1P vendor community buzzing with curiosity about 3P selling – either switching completely or, more commonly and realistically, deploying a hybrid selling strategy that leverages both Vendor and Seller Central.

It’s understandable:

- AVNs were at least somewhat challenging for 72% of 1P brands, and another 14% of brands classified their negotiations as unsuccessful or unresolved.

- 91% of 1P brands saw an increase to their total trade terms (including base rate/co-op/ MDF, damage, freight, returns allowances, AVS, and other items).

- 61% of 1P brands tell us profitability management is one of their biggest challenges on Amazon.

We’ve warned 1P vendors before to avoid a “grass is greener” mentality to 3P selling – AVNs have advantages over 3P, and 3P doesn’t guarantee higher growth or profitability, nor will it automatically solve underlying issues in your business like a lack of marketplace control or ill-fitting unit economics.

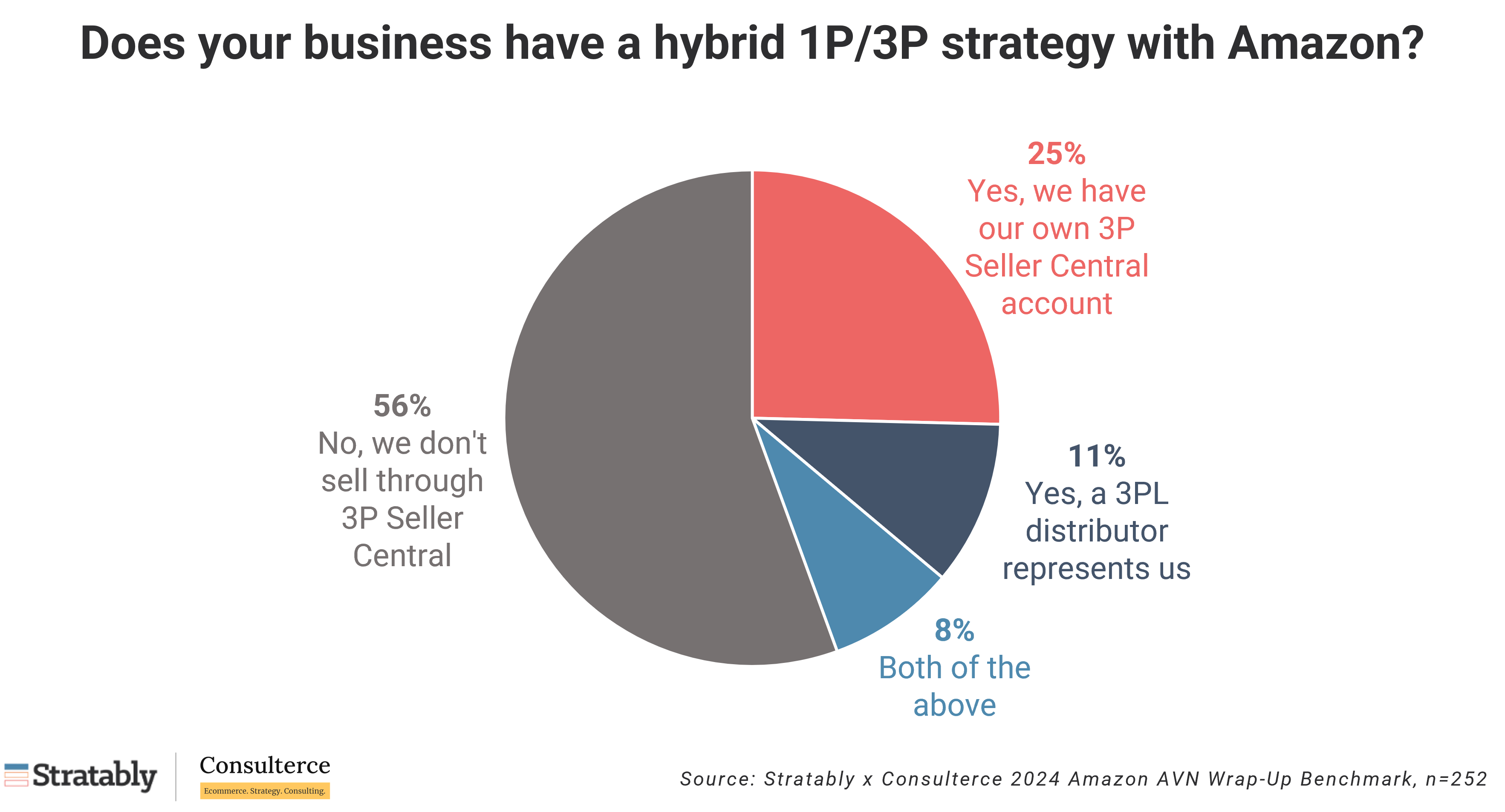

But nonetheless, we were eager to understand how prevalent the hybrid strategy is, so we benchmarked 250 brands to see what we could learn.

This article shares how many brands are using a hybrid strategy today, what characterizes these brands, and how it may be helping their 1P business.

Let’s dive in.

Join the Stratably community

-

Bite-sized market updates

-

Deep dive analyses

-

Industry benchmarks

-

Retailer forecasts

-

Invites to live events

-

And More!

Enterprise Membership unlocks our full insights that you and your team can use to drive alignment across your organization, improve your forecasting, and invest in the right capabilities.

Simply put, it makes your organization much more informed, providing a competitive edge over your rivals.