February 1, 2023

2 minute read

Stratably hosted Patrick Miller from Ascential to explain how brands can measure customer lifetime value by cohort via AMC, and what actions that can drive.

Watch the session here

Create a competitive edge

We often encourage Amazon NAMs, heads of eCommerce and their senior leadership colleagues to think about how they can create a competitive edge on the ultra-competitive Amazon marketplace.

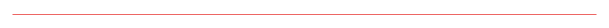

The diagram below illustrates why AMC, along with Attribution and Stream, should be key priorities for brands through the competitive edge lens – they all can drive a big impact and only a minority are using them today.

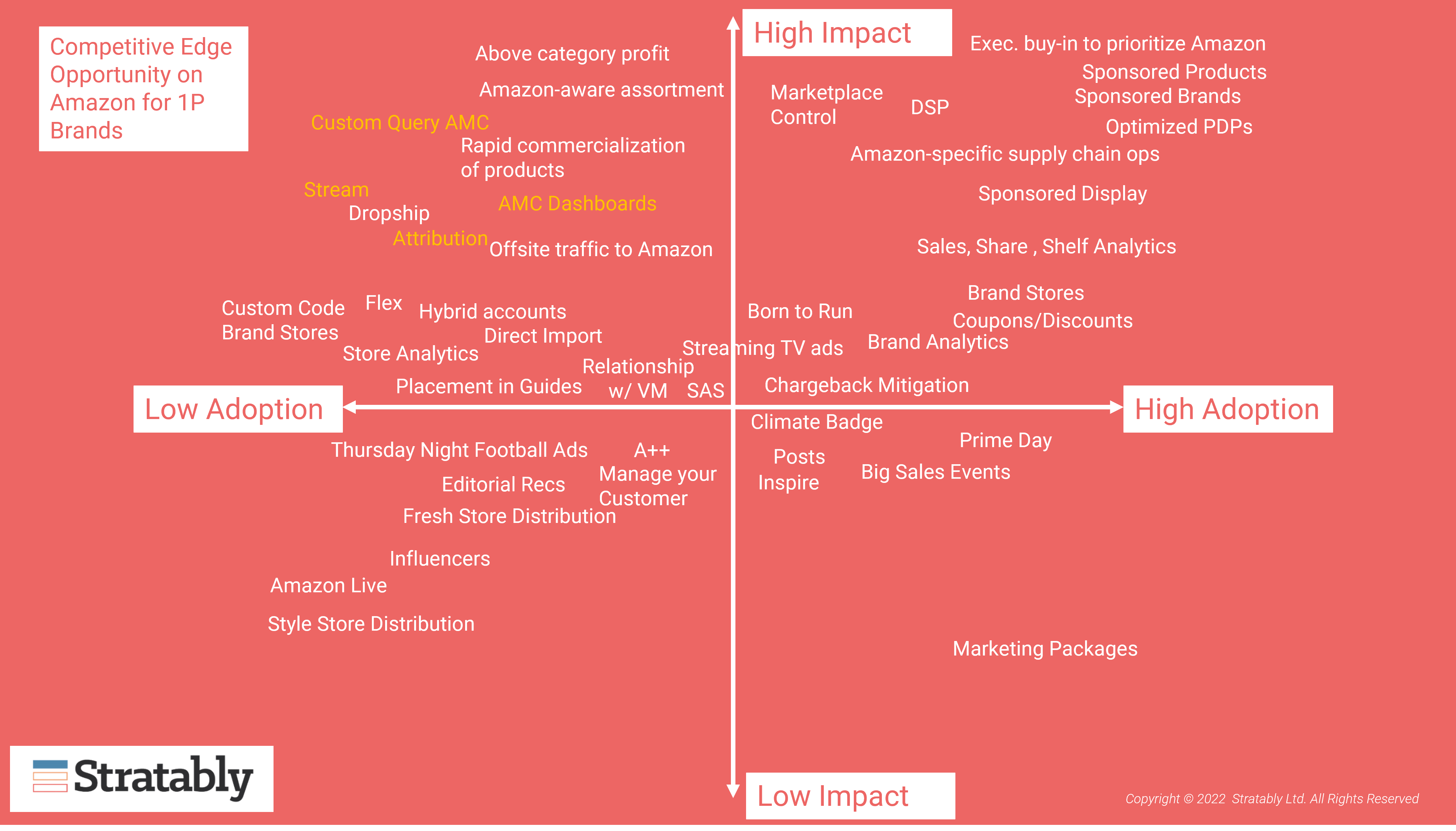

Stratably’s research in advance of the webinar confirmed too few brands are using AMC. Just 37% of brand attendees are using it today.

Two-thirds of those using the tool today report it having a positive or somewhat positive impact on their Amazon business, with a third indicating it has had no impact.

While these results could be characterized as mediocre, they’re more a symptom of users often not having a partner that is well experienced on AMC. This means the blank page nature of the platform is a bug rather than a feature, and it turns off some users too early on in the process of discovering the full potential.

We encourage brands to make AMC, along with Attribution and Stream, a priority in 2023 and stick with that commitment for several quarters before making conclusions on the merits of the platform. Further, we encourage brands to ensure those using the platform, whether internal resources, Amazon ad executives, or agency partners have the right skillset and motivations to get the most out of the tool.

Drivers to increased adoption of AMC

Stratably forecasts AMC adoption will move higher in ’23 as more brands are growing familiar with the possibilities of AMC, agency partners are increasingly adding resources to help them tap into it, and Amazon continues to add more data to the platform (i.e., making it more useful).

Further, the sooner brands start using AMC, the better as they otherwise lose out on historical data.

Some of the use cases for AMC:

- More comprehensive (length and ASIN breath) measurement of customer lifetime value

- Understanding gateway ASINs that drive shoppers to purchase more of your portfolio

- More granular and accurate understanding of the actual path to purchase

- Building DSP audiences to reach higher value shoppers

- Measuring the influence Amazon ads has on DTC sites

- More accurately measuring incrementality

These use cases most commonly drive changes to how much brands spend on Amazon advertising, how they allocate that advertising across ad units and their selection.

Here’s what we found most interesting from the live session:

- AMC enables a more comprehensive understanding of the value of a customer by extending the analysis to more ASINs and over a longer period. This more comprehensive view leads to a fundamentally new understanding of what a brand should be willing to pay for customer acquisition.

- There is no typical owner of AMC inside consumer brands. Sometimes it’s the Amazon team, sometimes its analytics team, sometimes its brand. But usually there’s an evangelizer inside the organization that gets it going.

- Prior to AMC there was no ability to measure customer lifetime value as comprehensively as there is today. Repeat purchase reports didn’t look back far enough and the SNS financial report does not show where shoppers came from.

- Brands should be starting on AMC today as historical data gathering starts once the instance is created. In other words, if you start one month from today, then you have one less month of data.

- AMC was technically built to not allow Amazon to use the data uploaded by brands for their own business purposes. Thus, worries around sharing competitive information with Amazon is not an ongoing policy or strategic decision for Amazon, but one that has already been made through technology decisions.

- AMC’s full power won’t be realized with dashboarding because companies are unique. They use unique media strategies, repeat cycles vary by product or brand, companies have different downstream ASINs to sell, etc. In addition, dashboarding, once widely adopted, lacks a competitive advantage if rivals are using the same dashboarding.

- Analyzing new to brand is not usually helpful for long repeat purchase categories. However, AMC can unlock cross-sell insights that can be useful.

- While inaccurate data or findings are not a common problem, too granular of queries is a common one.

Watch the session here