TL;DR: Instacart is growing faster than the grocery market overall (brick and mortar plus digital), but its growth is less compelling when compared specifically to the eGrocery channel. No major catalysts appear on the horizon to accelerate GTV in 2025, and foundational issues around brands growing ad spend remain.

3 minute read

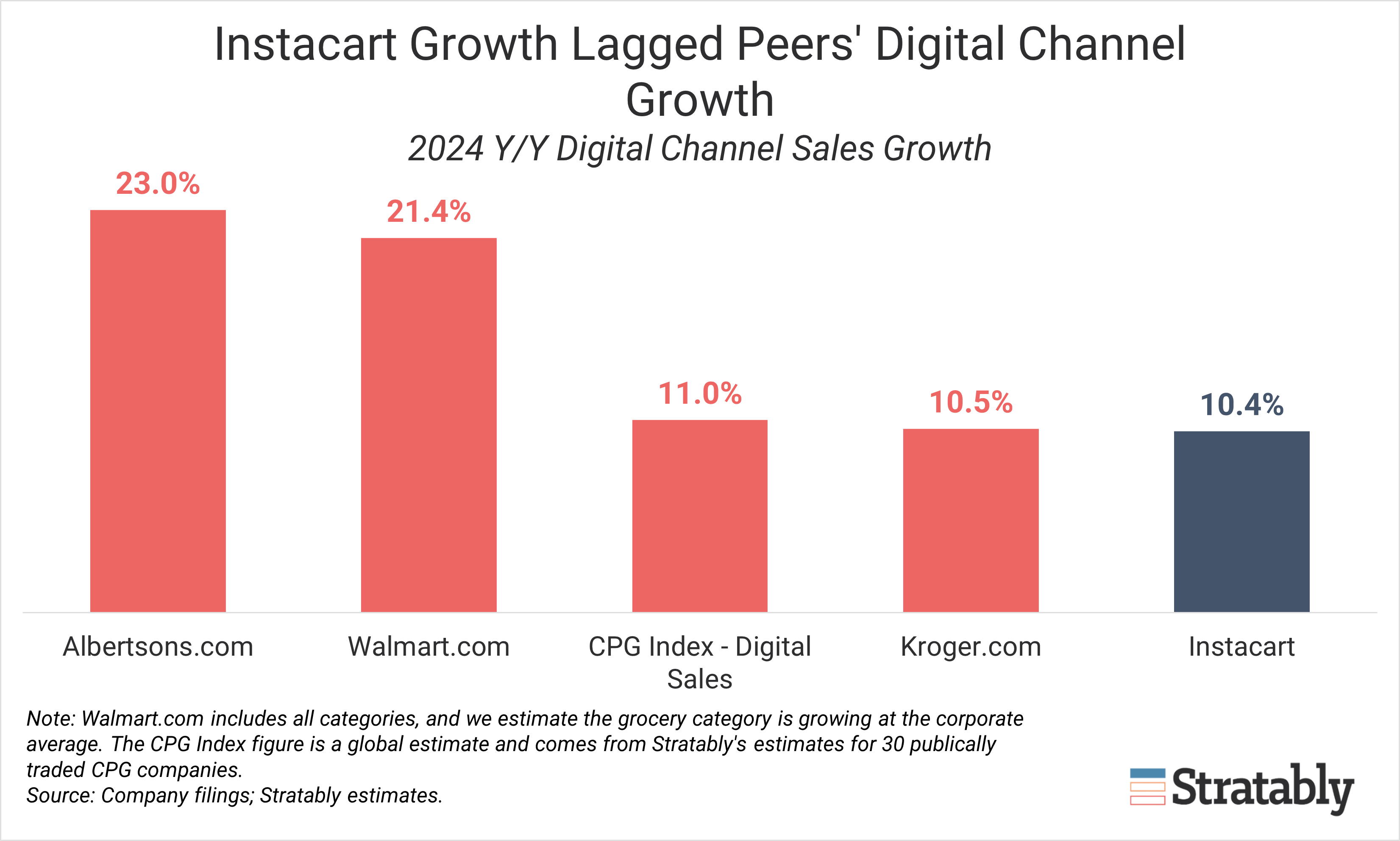

Instacart released its 4Q24 and full year results, demonstrating faster growth than the broader grocery industry, but relatively lackluster performance within eGrocery channels.

The Insight (What’s Happening?)

Instacart’s 4Q24 and full-year results confirm what we’ve seen for the past 12 months:

- It remains an important eGrocery platform for brands ($33 billion in Gross Transaction Value (GTV) – a close proxy for sales on its platform).

- It’s growing faster (+10.4% Y/Y in ‘24) than the grocery market (low single digits) but not outpacing other digital channels like Walmart.com and Amazon.

- Brands tell us Instacart is lagging Amazon and Walmart in retail media innovation, capping its potential with advertisers.

Why It Matters (Brand Implications)

Join the Stratably community

-

Bite-sized market updates

-

Deep dive analyses

-

Industry benchmarks

-

Retailer forecasts

-

Invites to live events

-

And More!

Enterprise Membership unlocks our full insights that you and your team can use to drive alignment across your organization, improve your forecasting, and invest in the right capabilities.

Simply put, it makes your organization much more informed, providing a competitive edge over your rivals.