TL;DR: Target’s outlook for the year ahead reinforces value-focused consumer behavior persists, hurting its business while helping rivals Walmart and Amazon. Brands will be focused on leaning into personalized promotions, on-trend innovation, and digital excellence to capture share gains, while maintaining a moderate pace of spend on Roundel.

5 minute read

Target reported its fiscal year 4Q25 results this morning, sharing information on comps, category performance, digital performance (including Roundel and Target+) and its outlook for the year ahead.

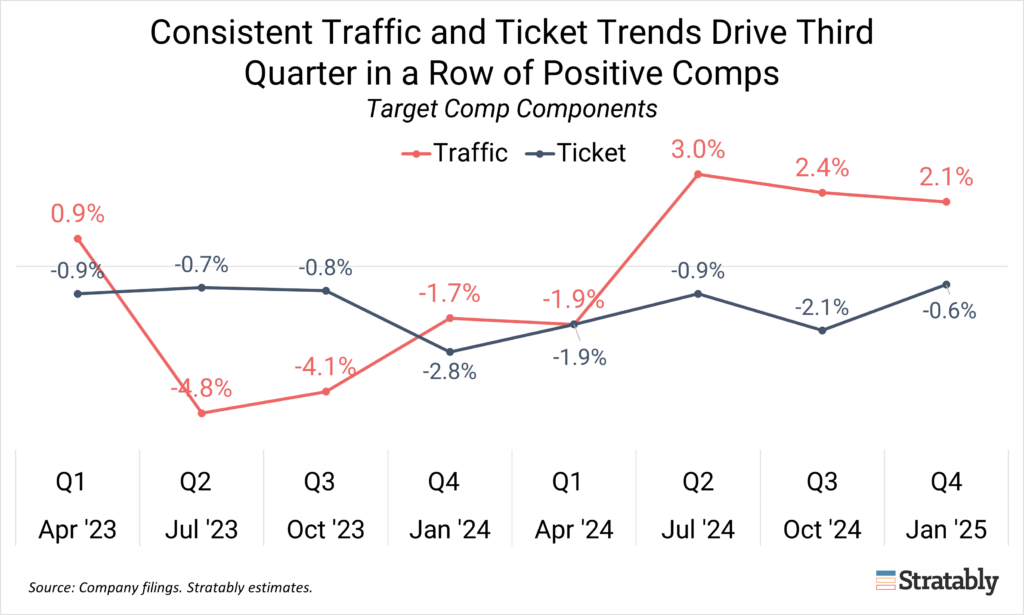

This was the third quarter in a row of positive comps, which came in at 1.5%, driven by traffic (+2.1%) and partially offset by ticket (-0.6%). Digital sales were a meaningful contributor, growing 8.7% Y/Y in the quarter, although a deceleration from 10.8% Y/Y in the prior quarter.

Guidance for the year ahead was disappointing, with management forecasting net sales growth of just 1% in 2025 on flat comps as it has seen a weak February and is concerned about deteriorating consumer confidence.

“During February, we saw record performance around Valentines Day. However, our topline performance for the month was soft, as uncharacteristically cold weather across the U.S. affected apparel sales, and declining consumer confidence impacted our discretionary assortment overall,” said Jim Lee, chief financial officer.

This guidance suggests the value-focused consumer behavior (what Target management has termed “resilient” and “resourceful” in the past) that has been present for the last two-plus years is persisting, hurting retailers like Target perceived as “premium”, while benefitting its rivals like Walmart and Amazon, both of which are projected to grow faster this year.

Thus, the story on Target remains unchanged. It needs a more stable macroeconomy, with confident consumers willing to trade off price for an elevated experience and premium products (i.e., Target’s calling card). Until that happens, outsized growth will be hard to come by.

Read on for an analysis of the results, including:

- Key stats and financial highlights

- Detailed analysis of management’s five-year goals

- Brick & Mortar vs. Digital forecasts

- Target+ GMV forecasts

- Roundel outlook

- Target's key areas of investment

- Category commentary

- 6 key action items for brands

Join the Stratably community

-

Bite-sized market updates

-

Deep dive analyses

-

Industry benchmarks

-

Retailer forecasts

-

Invites to live events

-

And More!

Enterprise Membership unlocks our full insights that you and your team can use to drive alignment across your organization, improve your forecasting, and invest in the right capabilities.

Simply put, it makes your organization much more informed, providing a competitive edge over your rivals.