August 1, 2024

4 minute read

Amazon released its second quarter results this evening, providing valuable insights into its performance over the last three months.

Each time Amazon reports, we ask and answer the following questions:

- How did its retail and ad businesses perform relative to prior trends?

- How did it fare compared to its peers or the market?

- Do the results cause us to change our view of the potential for brands on Amazon?

- What do the results tell us about Amazon’s position in the markets it competes in?

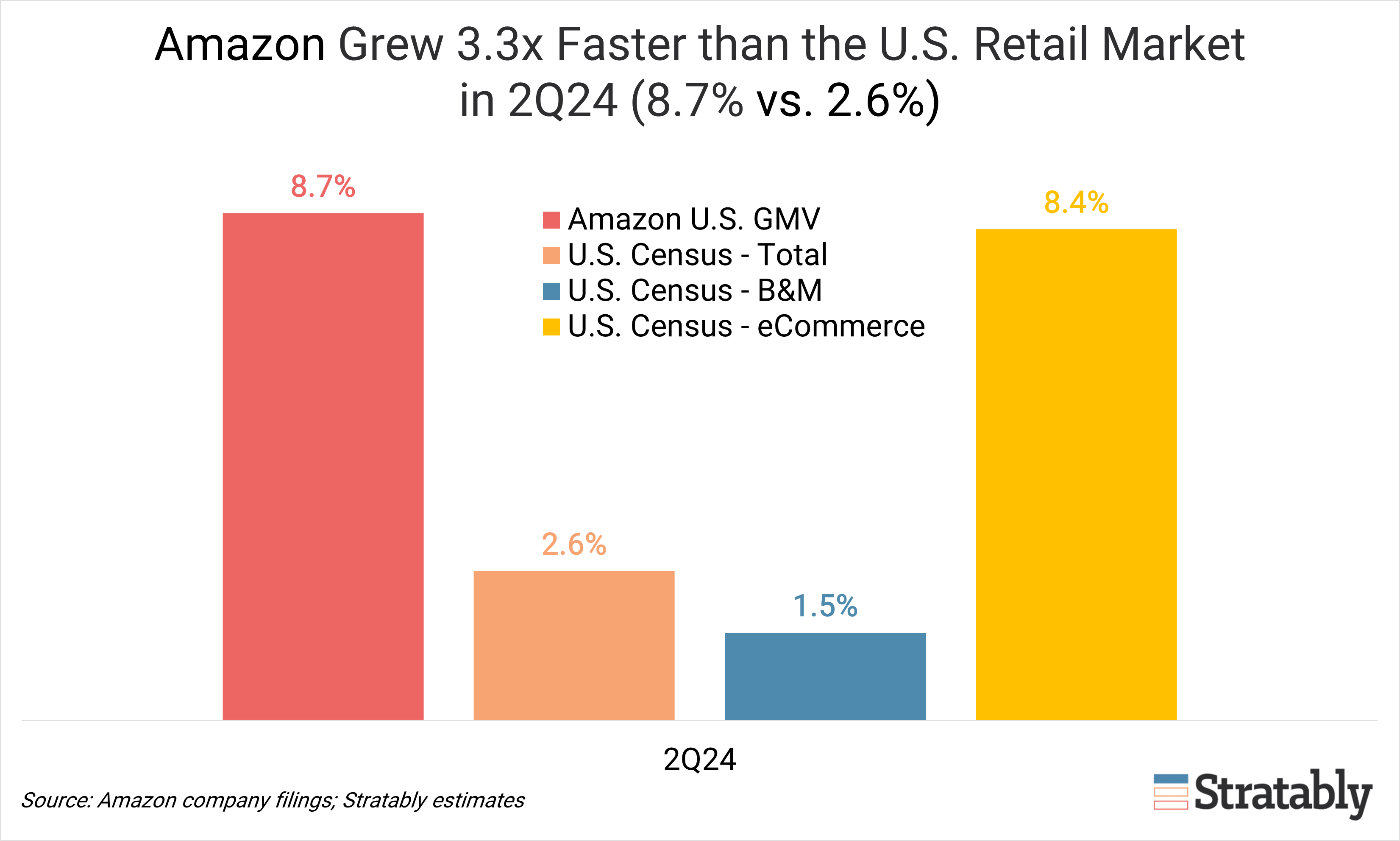

This quarter’s retail growth results were less stellar than in previous quarters, leading us to reduce our full-year estimates for its retail business. However, despite the moderated growth, Amazon significantly outperformed the broader retail market, both globally and in the U.S., and remains well-positioned to attract value-focused consumers.

In summary, while Amazon’s top-line performance showed a deceleration compared to past trends, it still outpaced its peers and maintained a healthy margin trajectory. Consequently, we expect brands to continue prioritizing Amazon in their growth plans for the remainder of 2024 and into 2025. Additionally, we anticipate Amazon will invest more aggressively in demand-creation levers in the upcoming quarters.

Below are 10 key takeaways for retail leaders that need to understand Amazon’s 2Q performance and its implications:

Join the Stratably community

-

Bite-sized market updates

-

Deep dive analyses

-

Industry benchmarks

-

Retailer forecasts

-

Invites to live events

-

And More!

Enterprise Membership unlocks our full insights that you and your team can use to drive alignment across your organization, improve your forecasting, and invest in the right capabilities.

Simply put, it makes your organization much more informed, providing a competitive edge over your rivals.