January 24, 2023

2 minute read

Stratably hosted Stu Clay from Tinuiti to dive deep into how brands can improve the performance of their spend on Walmart Sponsored Products.

Watch the Session Here

Research heading into the session

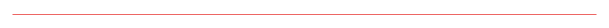

Stratably’s research in advance of the session indicated a net 35% of brands are planning to increase the percentage of their sales they reinvest into Connect as a result of these factors.

Interestingly, this figure compares to a net 25% of brands (sample overlapped but not identical) that plan to increase the percentage of their Amazon sales they reinvest into Amazon Ads, suggesting slight outperformance for Connect (at least on that dimension).

There are several factors driving growth of Walmart Connect:

- Walmart expects brands to advertise on its site and with its data as part of a brand’s overall commercial relationship with it.

- Walmart’s marketplace push will increasingly bring more 3P competition to the site, including bidding on paid search.

- Walmart’s shift to a second-price auction format (2PA) has resulted in much better returns for advertisers, naturally attracting brands’ retail media dollars.

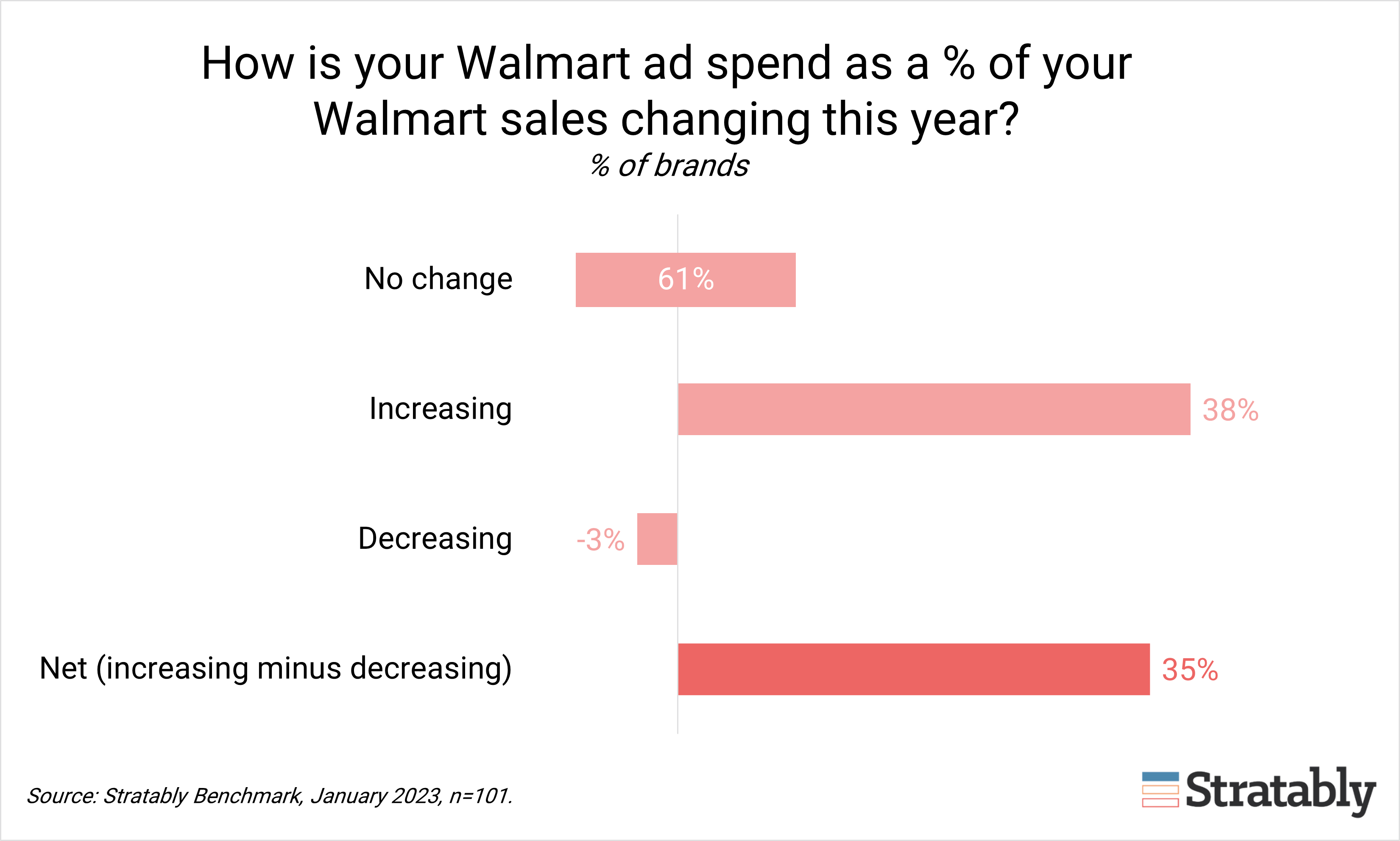

Stratably’s benchmark research also highlights slightly positive near-term trends for Walmart’s business in calendar 4Q. While the vast majority of brands saw performance at Walmart in-line with their expectations, a net 6% saw better than expected demand in-store and online.

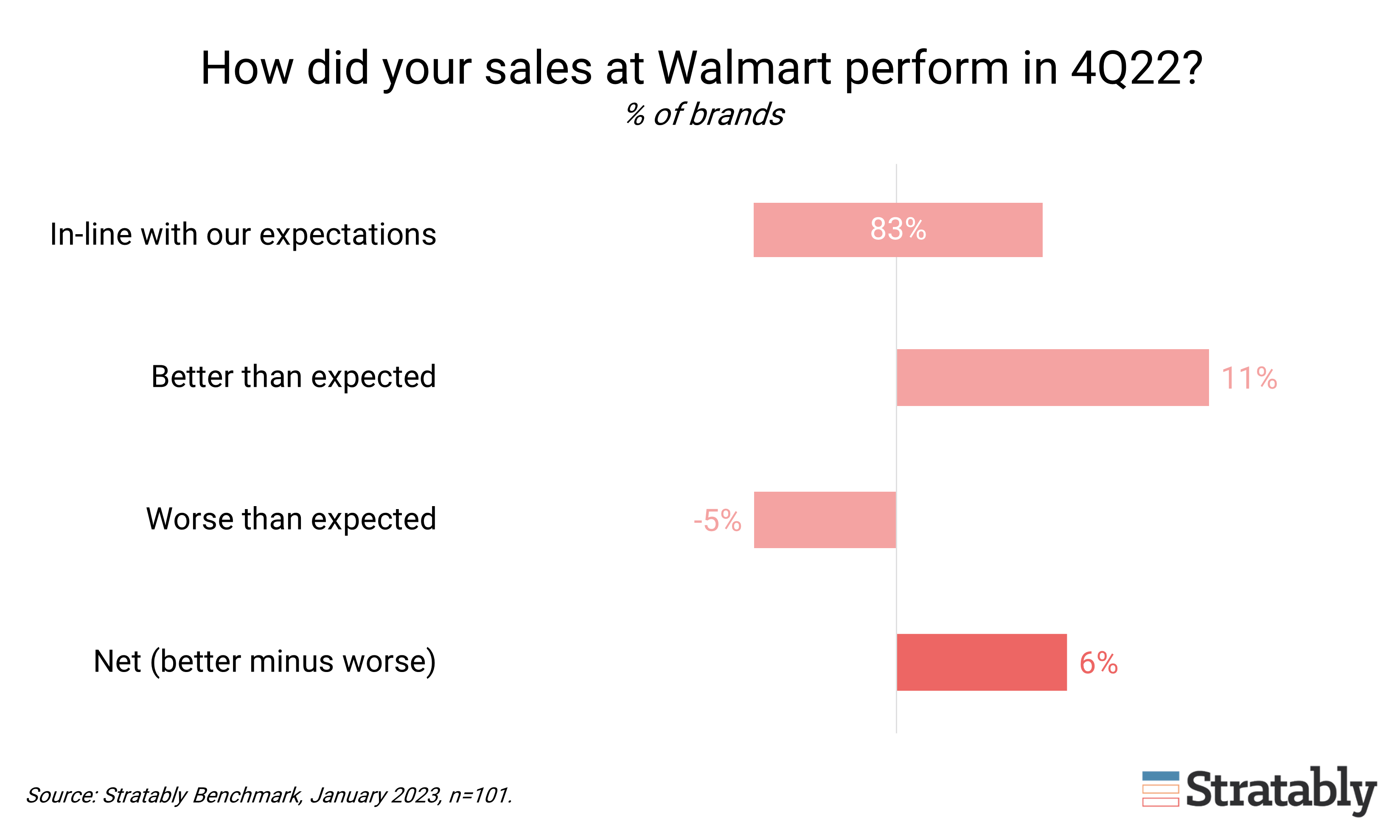

For comparison purposes, Stratably’s research on Amazon earlier in the month indicated a net 4.5% of brands indicated performance there was below expectations, with a wider number of brands both outperforming and underperforming.

Here’s what we found most interesting from the live session:

- Like on Amazon, operational readiness really matters - don’t advertise unless listing quality is strong (>70%), pricing is competitive (Walmart will suppress items not priced competitively), you’re winning the buybox (>70%), 2-3 day shipping or in-store pick-up available, and so on.

- Brands should approach Walmart Connect with fresh eyes – how it works, expected returns, what keywords matter, and so on will differ from Amazon Advertising or other platforms like Criteo .

- Advertisers are hoping (maybe even expecting) Walmart to introduce negative keywords and variant bidding this year; less clear if an AMC-like clean room is coming.

- Strategies like conquesting are not necessarily allowed, but they’re not heavily policed, so a brand may see a competitor do those types of activities.

- Tinuiti is seeing more 3P sellers start advertising on Walmart Connect and several boomerang advertisers – those that advertised pre-2PA and saw negative returns have come back post-2PA transition.

- Tinuiti recommends waiting 30 days or so when launching a new product before starting Sponsored Products just as a way to see if there are any tweaks needed around product content, operational readiness is there and to set a baseline for organic sales.

- 1P brands appear to still have an advantage over 3P sellers with homepage lockouts and some other ad units available to them, but 2PA was a leveling event.

- Will vary by category, but advertisers spend 10-25% of the amount on Walmart Connect as they spend on Amazon Ads.

- Closed loop attribution for in-store measurement remains challenging given the high percentage of cash transactions inside of stores.

- It’s very challenging to compare ROAS between Amazon and Walmart as it will vary significantly by category.

- Tinuiti uses Helium10, DataHawk and their own proprietary tech to inform SEO on Walmart; Walmart is expected to innovate here as well.

- Brands tend to take a crawl, walk, run approach with Connect, starting low funnel with Sponsored Products, then moving up funnel over time.

Feedback from the session was overwhelmingly positive:

- 100% rated it excellent or good

- 100% indicated the focus of the session met their expectations

- 72% plan to share the session with a colleague

- Key insight for one attendee… “Excellent and valuable webinar, opens my mind to Walmart Connect after a lackluster opening experience.”

Watch the Session Here