May 22, 2024

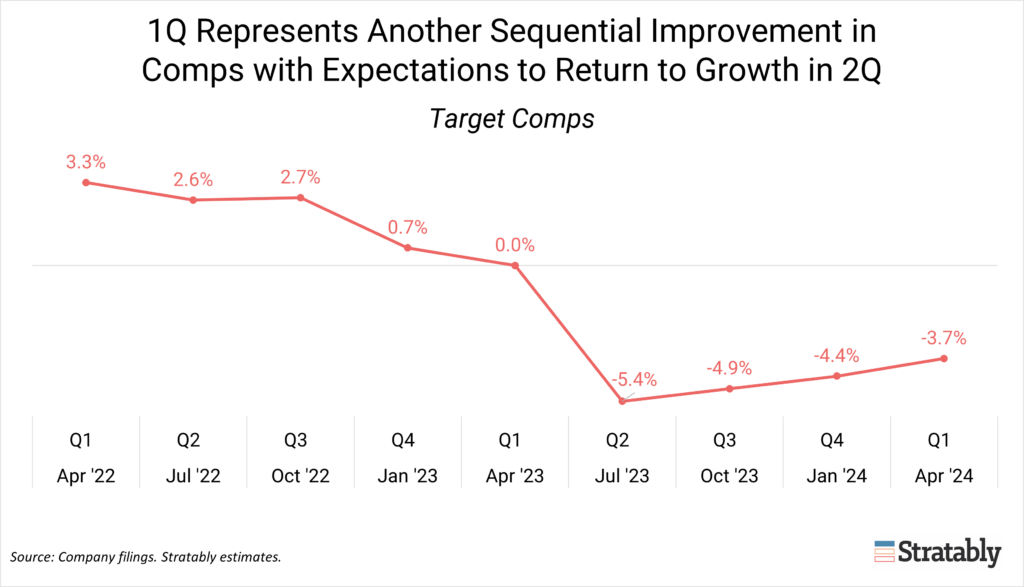

This morning Target reported another quarter of sequential improvement in declining comps (down -3.7%) as softness in discretionary categories continues to ease. Digital turned the corner into positive comparable sales territory (+1.4%) to offset mid-single-digit declines (-4.8%) in the stores business.

The company expects to return to positive growth in 2Q, with investments into newness and value, and easier comps, the key drivers.

Read on for a summary of the results, with a special focus on what digital leaders need to know.

Join the Stratably community

-

Bite-sized market updates

-

Deep dive analyses

-

Industry benchmarks

-

Retailer forecasts

-

Invites to live events

-

And More!

Enterprise Membership unlocks our full insights that you and your team can use to drive alignment across your organization, improve your forecasting, and invest in the right capabilities.

Simply put, it makes your organization much more informed, providing a competitive edge over your rivals.