TL;DR: Target struggled to keep pace with the market across its physical stores and the eCommerce channel, with profitability trending in the wrong direction. Management is facing a unique set of challenges as the consumer continues to look for great deals, while increasingly shopping online.

7 minute read

Target reported its 3Q25 earnings this morning, sharing information on comps, category performance and digital trends.

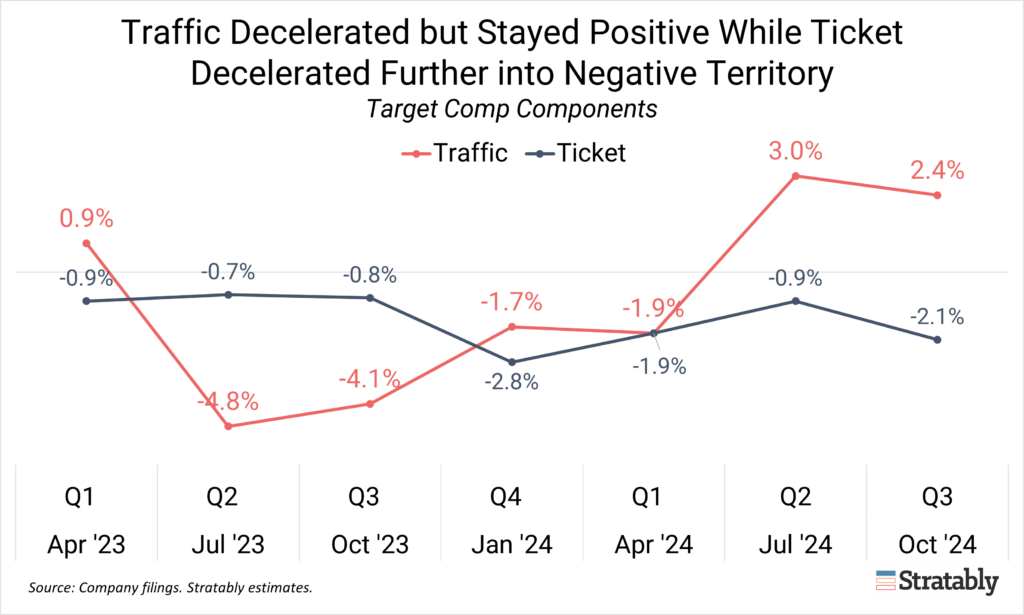

Comps retreated to 0.3% for the quarter, at the lower end of management’s original expectations. While Target has driven two quarters in a row of positive traffic trends, ticket declined further into negative territory this quarter, and its physical stores comp also turned negative.

Management called out unexpected rates of deceleration in discretionary categories, like Home and Apparel, as key contributors to these disappointing results, partially offset by continued positive trends in Food and Beverage, Essentials, and Beauty categories.

Digital was a relative bright spot, growing 10.8% Y/Y, an acceleration from 8.7% Y/Y in the prior quarter.

The following article analyzes these results in greater detail, including:

- Key stats and financial highlights

- 6 key action items for brands

- The implications of a resourceful consumer

- Category commentary

- eCommerce and retail media insights

Join the Stratably community

-

Bite-sized market updates

-

Deep dive analyses

-

Industry benchmarks

-

Retailer forecasts

-

Invites to live events

-

And More!

Enterprise Membership unlocks our full insights that you and your team can use to drive alignment across your organization, improve your forecasting, and invest in the right capabilities.

Simply put, it makes your organization much more informed, providing a competitive edge over your rivals.