March 8, 2024

Yesterday, Costco shared results from its fiscal quarter ending Feb-24, including solid performance in both the in-store and digital businesses.

Total company same store sales grew 4.8% in the U.S., driven more by traffic than ticket as inflation wanes, with management seeing Y/Y lower prices in some cases. Its strong in-store growth relative to others in the industry illustrates the compelling proposition it offers today’s value-conscious consumer.

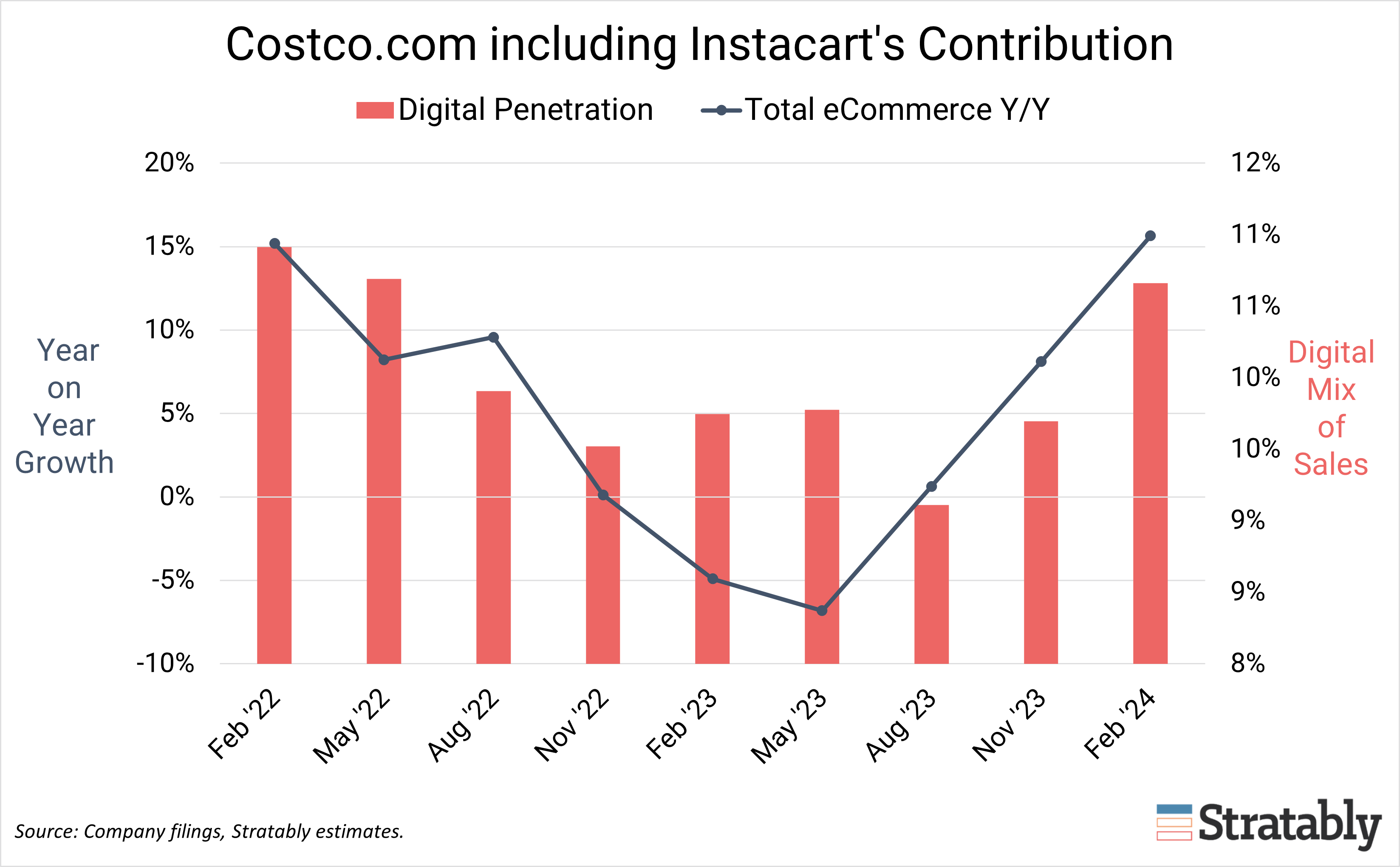

While its digital business is less integrated, less of a focus, and less traditional than its omnichannel peers (driven by gold, silver, gift cards, and e-tickets, for example), it had an impressive quarter of 18.2% growth, a significant acceleration from 6.1% last quarter and negative growth the two quarters prior to that.

If you’re a digital leader inside a CPG brand, this quarter was more of the same in that it hasn’t moved aggressively to drive its digital grocery business. Digital leaders inside hardlines and/or big and bulky items have more reason for optimism given Costco’s progress with its Innovel acquisition. But all things considered, this quarter’s results reflect our characterization of Costco as the exception to the omnichannel rule.

Today, we’re sharing the particulars of its digital business as well as interesting and need-to-know commentary from its quarterly investor call.

Join the Stratably community

-

Bite-sized market updates

-

Deep dive analyses

-

Industry benchmarks

-

Retailer forecasts

-

Invites to live events

-

And More!

Enterprise Membership unlocks our full insights that you and your team can use to drive alignment across your organization, improve your forecasting, and invest in the right capabilities.

Simply put, it makes your organization much more informed, providing a competitive edge over your rivals.