March 29, 2023

Stratably hosted John Shea from Momentum Commerce to explain the concept of “Durable Dominance” and what actions brands can take to not only win, but maintain, best seller rankings across their products.

Watch The Recording Here

It's not getting any easier on Amazon

Amazon’s double the size it was pre-pandemic and despite the layoffs and click-bait media headlines calling for its demise, it continues to be one of the fastest growing, at-scale accounts for brands. It’s even estimated to overtake Walmart’s pole position as the largest distribution channel in the U.S. this year.

The result is that every brand and marketplace seller has turned its attention to winning on the platform.

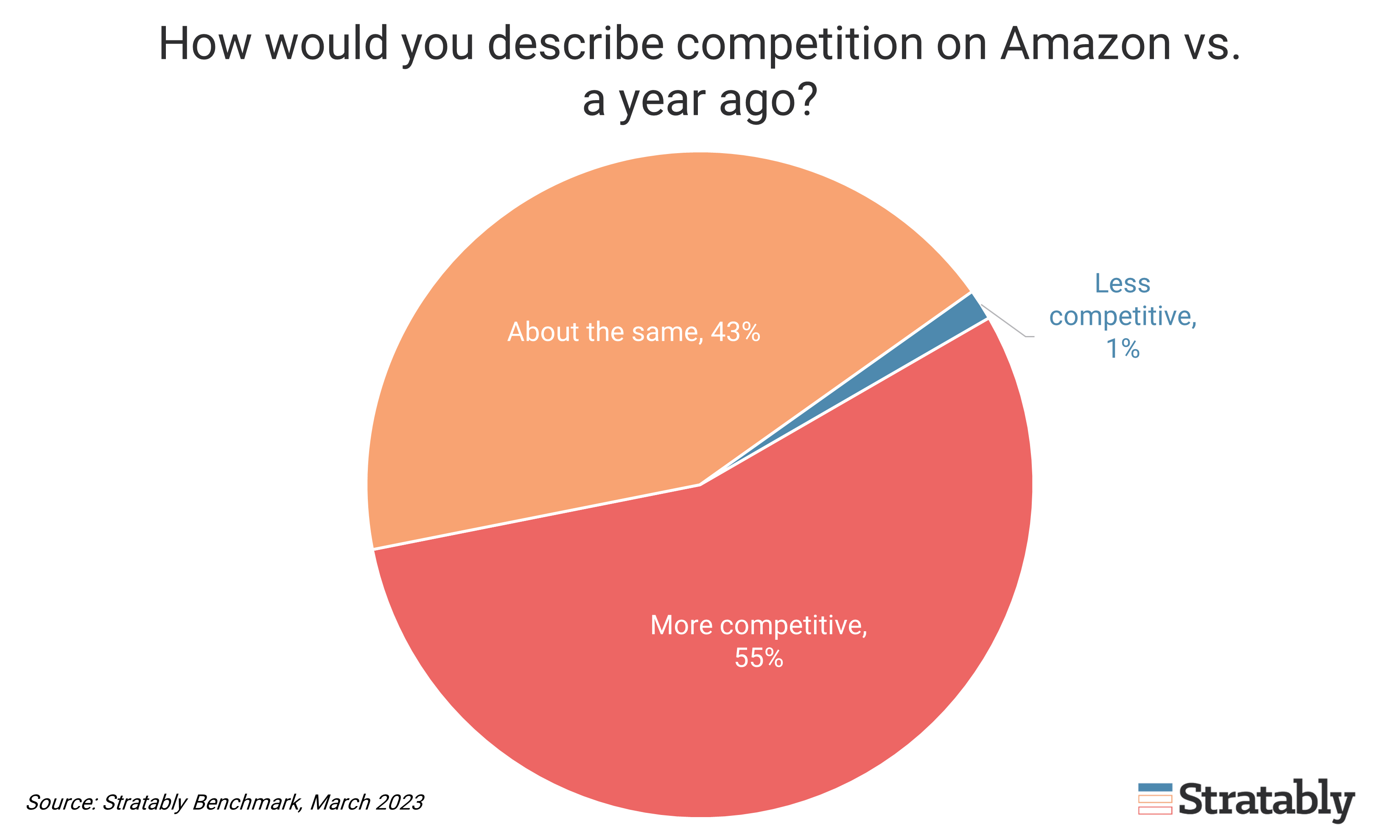

Based on our benchmarking, 55% of brands and agencies are seeing more competition on the platform versus a year ago compared to only 1% feeling as though it is less competitive.

This means it is harder to not only earn a best seller ranking (BSR) but maintain it, a concept Momentum Commerce coined as “Durable Dominance”.

Seven factors that determine "Durable Dominance"

There are seven factors that determine the probability of a best-selling product maintaining that ranking over the long-term:

- Advertising (e.g., paid share of voice)

- Brand Equity (e.g., branded search)

- Reviews (e.g., relative reviews to competitors)

- Ratings (e.g., relative ratings to competitors)

- PDP Content (e.g., content completeness and relevance)

- Availability (e.g., in-stock rates)

- Product uniqueness

Importantly, brands have varying degrees of control over each of these, enabling them to build a moat around their products. For instance, brands control how much they invest behind their brand advertising, the premiumization of their products within a category, whether they expand assortment on the marketplace beyond what store shelves can hold, how much they advertise, and then how well their products deliver on their promise.

For each item, brands can develop a durable dominance index that can inform ASIN prioritization, new product development, advertising strategy, and so on.

Momentum Commerce has used this methodology to help inform clients on the overall value of Amazon businesses and recommend specific tactics to move the index scores higher.

Here’s what we found most interesting from the live session:

- Brands should offer more assortment on Amazon compared to what they sell in stores in order to cover more digital real estate. This can improve the ability to maintain BSR because the total brand share of voice (a significant factor in durable dominance) is higher.

- Moving price higher but maintaining the relative price rank can improve profitability without a material impact on BSR.

- The persistence of BSR may move higher over the next year because supply chain volatility and accompanying higher than normal out of stocks is lessening.

- Amazon’s A/B testing broad sales volume signals on products (e.g., “XYZ ASIN has sold 2,000 units in the last month”). This provides shoppers with a more recent signal of popularity compared to ratings or reviews (which are for the lifetime of the product), possibly altering their significance to durable dominance scores and influencing BSR.

- One product launch strategy that has worked is to start by discounting a new product to earn the BSR and then gradually move price higher.

- On average, review scores of 4.3 and above have greater persistence of maintaining BSR. It can be challenging for a brand to take a product with a sub-4.3 rating and move it higher over time. Therefore, the advice is to use ratings as a guide towards prioritizing ASINs. For instance, if you have two similar products and one has a 4.5 rating and the other a 4.0 rating, then it may be worth doubling down on the 4.5 rating.

- Amazon’s Choice badge has a positive impact, but it is not as big of an impact as the Best Seller badge. 3P sellers have access to the search query report in seller central that can help quantify the impact of the Amazon Choice badge.

Watch The Recording Here