December 1, 2022

12 minute read

Is it incremental?

That's a challenging question many digital leaders have been asked when they look to expand or invest larger amounts into certain channels.

- If you expand from 7-Eleven to Gopuff, is the Gopuff sale incremental?

- Is expanding to Walmart stores incremental if you only do DTC today?

- What about launching products on Walmart’s marketplace after years solely dedicated to Amazon’s?

The core of the question gets at whether the necessary investment should be incremental itself or if the firm should shift resources from somewhere else. The logic goes, why put incremental investment into something that doesn't drive incremental sales.

But despite the commonness of the question, it can be difficult to answer precisely because there are different angles to consider when thinking about incrementality.

Let's go on a journey to unpack this question and develop a repeatable framework to assess whether a new initiative is incremental.

Defining incrementality

Incrementality is a sale that otherwise would not have occurred if it weren't at a given retailer or featured in a given ad.

It's challenging to know if a sale fits this definition because we have imperfect information.

For instance, if you sell ice cream in convenience channels and you expand to Gopuff, is a sale incremental? You don't necessarily know with much granularity whether the individual who bought a pint at 10pm is still going to buy a gallon during their weekly stock-up trip.

You could compare sales volumes over time of course, but a typical brand has many moving parts like new product introductions, promotions, advertisements, changes in inventory and so on making the comparison difficult. In addition, sales and share providers don't track all retailers, especially new ones.

Further complicating the effort is that you must actually sell through the channel to be able to start doing this type of analysis. But if you go to market half-heartedly or in a small test-and-learn way, that might not uncover the full potential.

This is what Stratably describes as a chicken-and-egg problem when considering incrementality.

And even if we could answer these questions, what about competitive realities?

Let's assume a firm gets confidence that Gopuff is not incremental, but a shift out of convenience channels.

If it doesn't want to commit incremental resources to Gopuff, then that opens the door for competitors to win on Gopuff. A brand goes from selling a pint each week in traditional channels to selling a seven-eighths of a pint on average as the shopper now buys a competitor brand at Gopuff.

So, there's a competitive dynamic to the answer of incrementality as much as there is a consumption dynamic. No, the consumer won't necessarily eat net-net more ice cream over the course of the year, but our competitor will win more ice cream share if we don't move into the new channel.

Incrementality for who?

Sometimes we want to understand if a new model being rolled out by an existing channel is incremental to our existing business with it. For instance, Kroger is expanding its business into markets where it will only have a digital presence.

Other times we want to assess whether a model like Gorillas is incremental to the grocery market. For instance, does the ability to place an order and receive an item in 15 minutes create net new consumption? Maybe a consumer realizes she’s missing an ingredient and decides to place an order with Gorillas rather than foregoing the recipe altogether.

Thus, the comparison matters and can lead to different conclusions, making answering the question difficult.

In summary, answering the incrementality question is challenging:

- We have imperfect information about sales and share.

- There’s a chicken-and-egg problem related to getting started

- Competitive realities mean the analysis is sometimes about not losing share vs. growing the total pie

- Incrementality answers can differ depending on which entity we’re considering – for our brand, for the retailer, for the market.

Pause before moving to the next section and consider this question:

Has your company avoided certain channels in the past because it did not get conviction on incrementality? In hindsight, was that decision right or wrong?

A New Incrementality Framework

Rather than do a bunch of hand waiving when asked about incrementality, the six question framework below can be followed when a brand is evaluating new channels and trying to predict future winners.

(1) Does the channel enable net-new assortment?

Does a new channel open the door towards introducing new assortment.

On Amazon, that might manifest itself with a bigger pack size that helps drive net-greater consumption. Or on a mass-market brand's DTC site, that might be unique flavors or limited time offers.

In contrast, an omni-channel retailer that doesn't offer online-only items can't offer net-new assortment.

(2) Does the channel reduce friction in a meaningful way?

Amazon enables a shopper to quickly find and then purchase items. Within seconds you can have a general merchandise order beginning the process of traveling from the FC to your home. There is almost no friction, turning any item into an impulse item.

Gorillas or DoorDash's marketplace are other examples where super-fast delivery speed creates a new dimension of convenience.

New channels that bring a new level of convenience to the market have a chance to create more impulsive buying.

(3) Does the channel create new opportunities for consumption?

Quick service restaurants see launching a breakfast daypart as incremental to serving their consumers lunch and dinner.

Similarly, a model like Gopuff that can deliver late at night introduces a new daypart for the brands it sells.

To stick with the ice cream example, maybe the shopper simply wouldn't consume ice cream at midnight if it couldn't get it delivered.

Or in the case of Drizly, a consumer simply wouldn't have been able to order liquor at 1am in the past.

Or let's say you're a beverage brand distributed in most mass markets and you get new distribution in a home improvement check out line. The contractor can easily add the item while checking out, increasing conversion compared to relying on an additional stop at a convenience shop on the way to the jobsite.

(4) Does the channel reach net new shopper demographics?

New channels can be super-aligned to certain demographics. Gopuff for example was targeted at Millennials when it first got started and still over-indexes to younger generations.

A brand that under-indexes to these demographics may therefore be able to help close that gap by distributing products there. Or, a DTC brand might find expanding to Walmart stores simply exposes them to more people than what they can efficiently do online.

In this case, awareness is relatively low, creating an incremental opportunity.

(5) Does the new channel speak to consumers in a different way?

Livestreaming or influencer-driven models jump to mind as mediums that can speak to shoppers in new ways, providing incremental information and social credibility that stores or typical online storefronts can't.

This enhanced information component can be particularly impactful for highly competitive categories (think influencer-driven beauty brands) or for highly researched products that might be complex to use (think furniture or consumer electronics).

(6) Are competitors selling in the new channel?

There is one big caveat to all of the above - competition.

Let's say a new channel opens that doesn't enable net new assortment, doesn't reduce friction, doesn't drive additional consumption, and doesn't reach new shopper demographics. But…competitors have decided to sell there.

Now, this is a bit hypothetical because why would the new channel succeed in the first place without some compelling reason. But setting that aside, in this case, the demand is likely going to shift out of other channels towards the new channel and towards one's competitors if a brand isn't there, unless a brand enjoys incredible loyalty.

Thus, a channel can be incremental simply due to the competitive dynamic.

Advertising and Incrementality

All of the above questions don’t contemplate whether advertising drives incremental sales.

That, fortunately, is beginning to get answered in very granular ways as retailers like Amazon provide new-to-brand metrics.

Instead of shifting a bunch of search funds to branded terms and applauding ROAS increasing, brands are instead saying, let's grow actual sales and maybe that means non-branded and/or conquesting tactics are preferred even if ROAS is lower.

Since advertising is the new algorithm, brands have to invest in retail media. But how they spend that can be driven by the metrics they are optimizing, like new to brand and incrementality sales.

In summary, here are the questions to consider when evaluating incrementality:

- Does it enable us to create net-new assortment?

- Does it reduce friction in the buyer journey?

- Does it create new consumption patterns (or dayparts)?

- Does it reach new demographics?

- Does it speak to consumers in a different way?

- Are competitors selling in the new channel?

Before moving on to applying this framework, consider these two questions:

- Does your organization seem to focus on certain framework factors more than others? Why?

- Does your business require additional framework factors to complete the analysis?

Applying the Framework

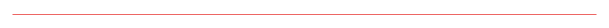

Let’s dive into some examples to help illustrate the framework in use, through the lens of a mass market brand with existing widespread distribution.

- Amazon: It enables brands to offer net new assortment compared to what might be found in stores, and its one click check-out capability is the definition of reducing friction in the buying process.

- Walmart Pick-Up: If a brand assessed this relative to its in-store business, it would see pick-up can reduce friction and can attract a net new demographic to the Walmart ecosystem.

- Kroger Ocado digital markets: These offer brands the opportunity to sell different assortment than what is found in a Kroger store, although sales through this channel will likely come at the expense of other grocers that already exist in those markets.

- Gopuff: Incrementality is largely driven by its willingness to deliver at off hours and its potential to reach younger demographics.

- Gorillas: Q-Commerce garnered significant investment last year as 15-minute delivery both reduced friction (waiting) and the potential for new consumption patterns.

- Amazon Fresh physical stores: Just Walk Out technology reducing check out friction holds the most promise, but these stores largely seem like share shift opportunities when considering the grocery markets where they have opened.

Future Winners?

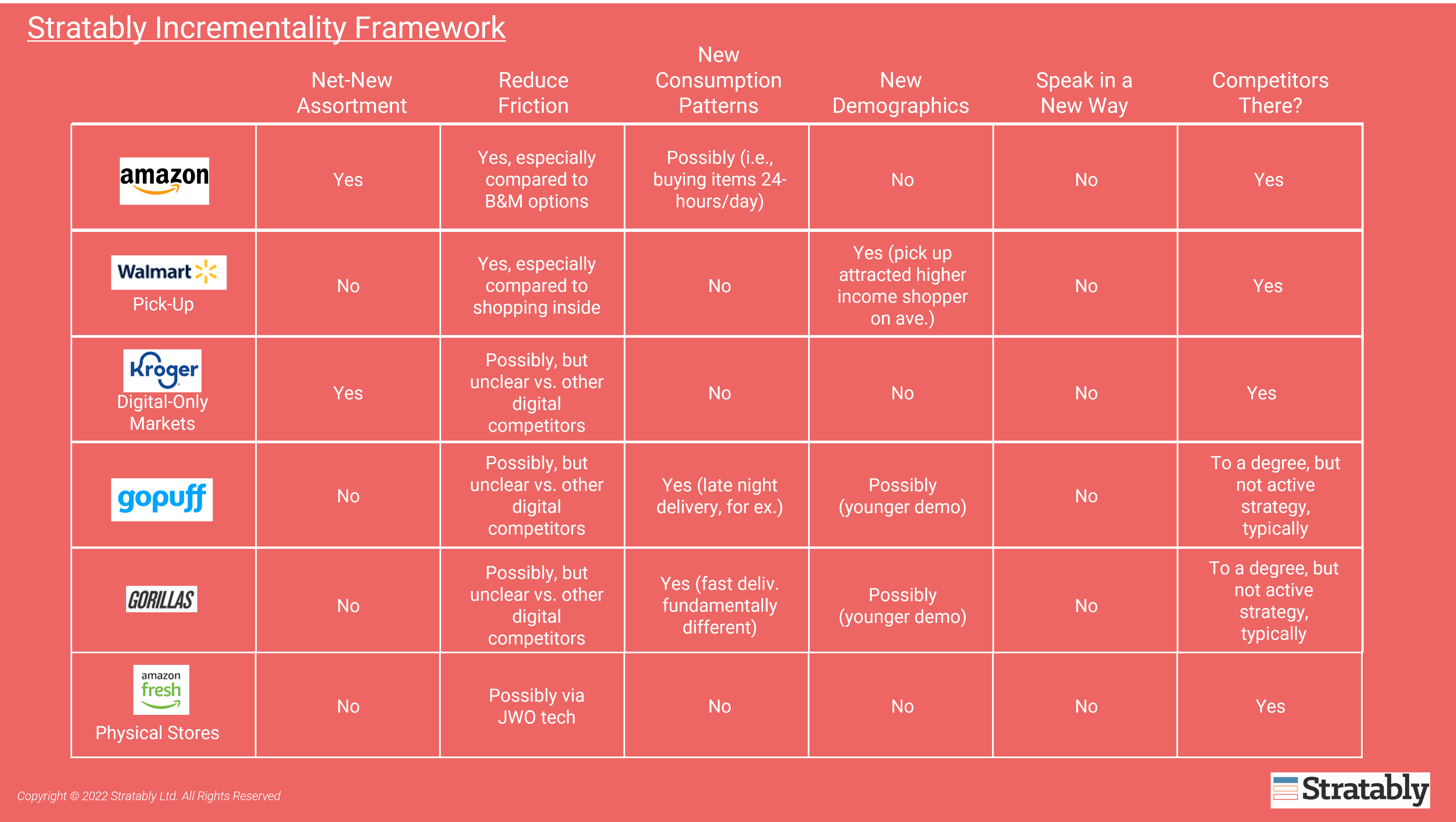

The framework can also help determine the potential trajectory of a new retail channel or explain strategies in a rigorous way.

- Instacart dark store: This enables a clear way for brands to offer net-new assortment, creating the conditions for incremental purchases.

- Social Commerce on TikTok: In theory, this should reduce friction in the buyer journey, but it takes a great deal of consumer awareness that they can buy on the platform.

- Shoppable recipes: In theory, this should reduce friction because you can one click to order all the ingredients for a recipe, but a shopper often has some of the ingredients in their pantry already. Thus, it's less clear.

- The "metaverse" (think activating in Roblox for now as an example): Engaging here enables the chance to reach new demographics, the virtual world nature of it means a brand can speak to consumers in different way, and new virtual assortment can be created. So there is high incrementality possible, but it’s such a nascent medium that it makes tapping into those elements challenging.

- Ghost Kitchens: The main opportunity with ghost kitchens is to speak to consumers in a new way, through a digital brand. In addition, one could argue this creates net-new assortment and the new brand could be targeted at a different demographic.

- Livestreaming: The biggest opportunity with livestreaming comes in the form of speaking to shoppers in a new, more engaging way. This can be powerful for new or heavily researched products.

The need for good judgement

The framework doesn't absolve us from the need for sound business judgement.

There isn't always a clear yes or no answer, but rather a spectrum available across these dimensions.

If the channel is of sufficient scale and/or has the potential to reach scale, then a brand should have reasonable confidence investing incremental dollars into winning that channel if the answer is yes, or it sits on the positive side of the spectrum on one or more of these dimensions.

Before moving on to X-Factors, ask yourself:

If you run new channels that you launched this year through the framework, is there an obvious incrementality benefit?

Incrementality X-Factors

The above framework considered incremental SALES as the focal point.

That largely makes sense, but it’s not necessarily the FULL picture.

There are other incremental benefits that new models or channels can provide that aren’t captured in the top-line. We can call these X-factors that must be accounted for in evaluating an opportunity.

Here are few that stand out based on conversations with digital leaders across the consumer brand landscape.

Data

Consumer brands are increasingly looking to capture zero-party or first-party data primarily through DTC channels. This data is growing more powerful with the development of clean rooms like AMC as it can be used to understand the full consumer journey.

DTC already allows a brand to offer “net new assortment” and “speak in a new way”, and this 1P data component is an additional X-factor driving investment.

Engagement & Community

Brands that engage with their consumers and build a community (which goes beyond an email list!) can generate a degree of loyalty that only shows up over the lifetime of a consumer. It’s difficult to truly engage and develop that community though and it can be costly. It’s also not-obvious how to do this.

Selling on Amazon or Instacart or Walmart doesn’t really do this for a brand. Even selling DTC doesn’t.

But developing a following inside Roblox or offering NFTs are recent attempts at it. The results of these efforts won’t show up on the top-line, but they are still generating incremental value.

Faster feedback loops

Speed is an asset in today’s digital environment. Nothing speaks to that more than retail media where consumer brands can get much more rapid feedback of ad performance compared to the year-long process of planning and executing in-store activations.

Amazon’s customer reviews are another X-factor helping make that account valuable beyond the sales impact to a brand.

The financial value of X-factors

The financial value of the X-factors listed above are much more difficult to assess than simply counting sales.

But precisely because of that, brands should consider these before dismissing a new channel because the incremental sales benefits aren’t obvious.

In other words, we must get comfortable not measuring everything OR enhance our measurement practices to account for the full picture.

A question to help apply X-Factors to your business:

Which account do we do business with that has the most amount of X-factor benefits that aren’t accounted for in top-line sales?

A Spectrum, rather than Yes or No

Answering the question "Are eCommerce sales incremental?" depends on the context of a given brand or channel and lends itself more to a spectrum than a binary yes or no.

Brands can apply the above framework to their specific business with new channels, giving them conviction on whether to expand or not.

If a channel does suggest incremental sales are likely, then the brand should expand there and make best attempts at measuring whether net new sales are occuring and/or how their category share across the market changes.