May 10, 2023

Stratably hosted Cara Wood from Salsify to share the results of a CPG consumer study focused on how shopping behaviors have changed since the pandemic.

Watch The Recording Here

Post-Pandemic, Inflation, Recession, New Technology...

It’s as dynamic a time as ever, which is saying a lot considering the pandemic, massive supply chain issues, and decades-high inflation have been keeping CPG leaders up at night for the last three years.

Digital certainly became more important for organizations as it has become a bigger piece of the pie.

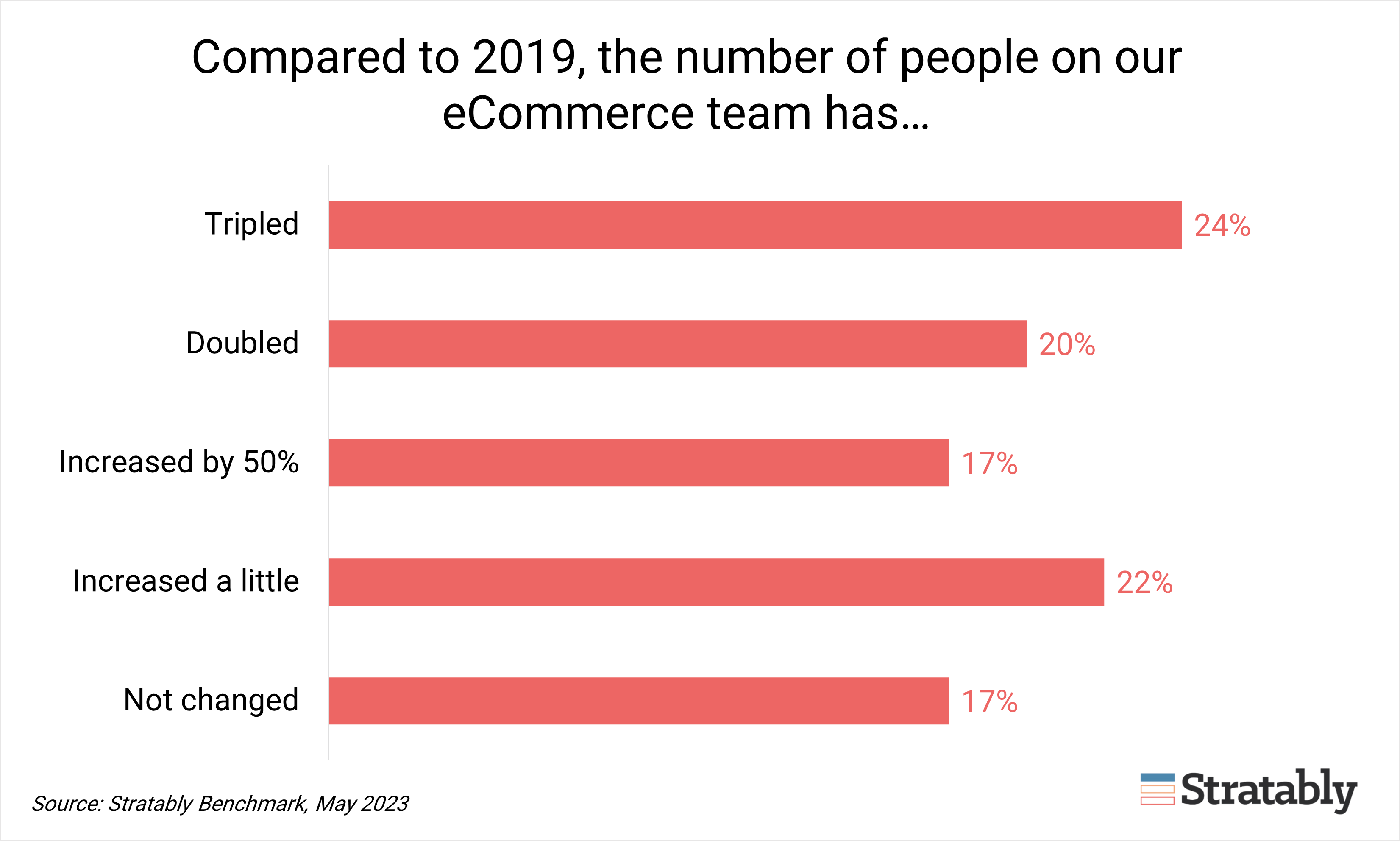

To support this growth, many organizations have built up their digital teams, an investment that will pay dividends as competition online has intensified amidst growth rates decelerating.

But in the last 18 months, consumers have gained the freedom to safely return to stores, online growth rates have decelerated, and a macroeconomic backdrop has emerged putting us on what feels like the precipice of a recession.

How does this all shake out in terms of consumer behavior?

We sat down with Cara to learn more about her research in this area including what behavior appears to have permanently changed, the impact of rising costs, what shoppers are willing to pay for, and the expectations they have for online experiences.

Here’s what we found most interesting from the live session:

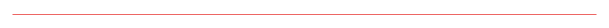

- Staying power of online shopping: Pre-pandemic, 33% of shoppers bought groceries online compared to 78% today. This staying power is translating to brands (58% have seen digital penetration grow by five or more points) and retailers like Walmart and Target (digital penetration rates up more than five points). This does not appear to be just a pandemic-era behavior as penetration rates have held steady and are growing off this larger base in the last 12 months.

- Promotions: Most CPG organizations and retailers we cover expect a more promotional environment to ensue in 2H23. The consumer study supported this expectation, with shoppers ranking promotions as a top determining factor in what they buy. Relatedly, two-thirds of shoppers in the study are looking to trade down to private label in an environment where they perceive prices as too high.

- Importance of reviews: While brands can’t directly influence positive reviews, setting the right expectation with PDP content and ensuring retailers are offering a high-quality delivery experience (i.e., not crushing the product) are important as the consumer rates reviews highly when considering what to buy. Reviews do not stand alone though. Rather, they work in concert with overall product quality and the capabilities of the retailer (for instance, the ability to do same day delivery).

- Content consistency: 20% of shoppers indicated they won’t buy a product if they find inconsistent data across retail channels, highlighting the need to standardize content (as much as retailers allow given their unique requirements).

Watch The Recording Here