TL;DR: The eCommerce channel grew 6.7x faster than physical store channel in the U.S. during 3Q24, and year-to-date it has amounted to 61% of total dollar growth.

1 minute read

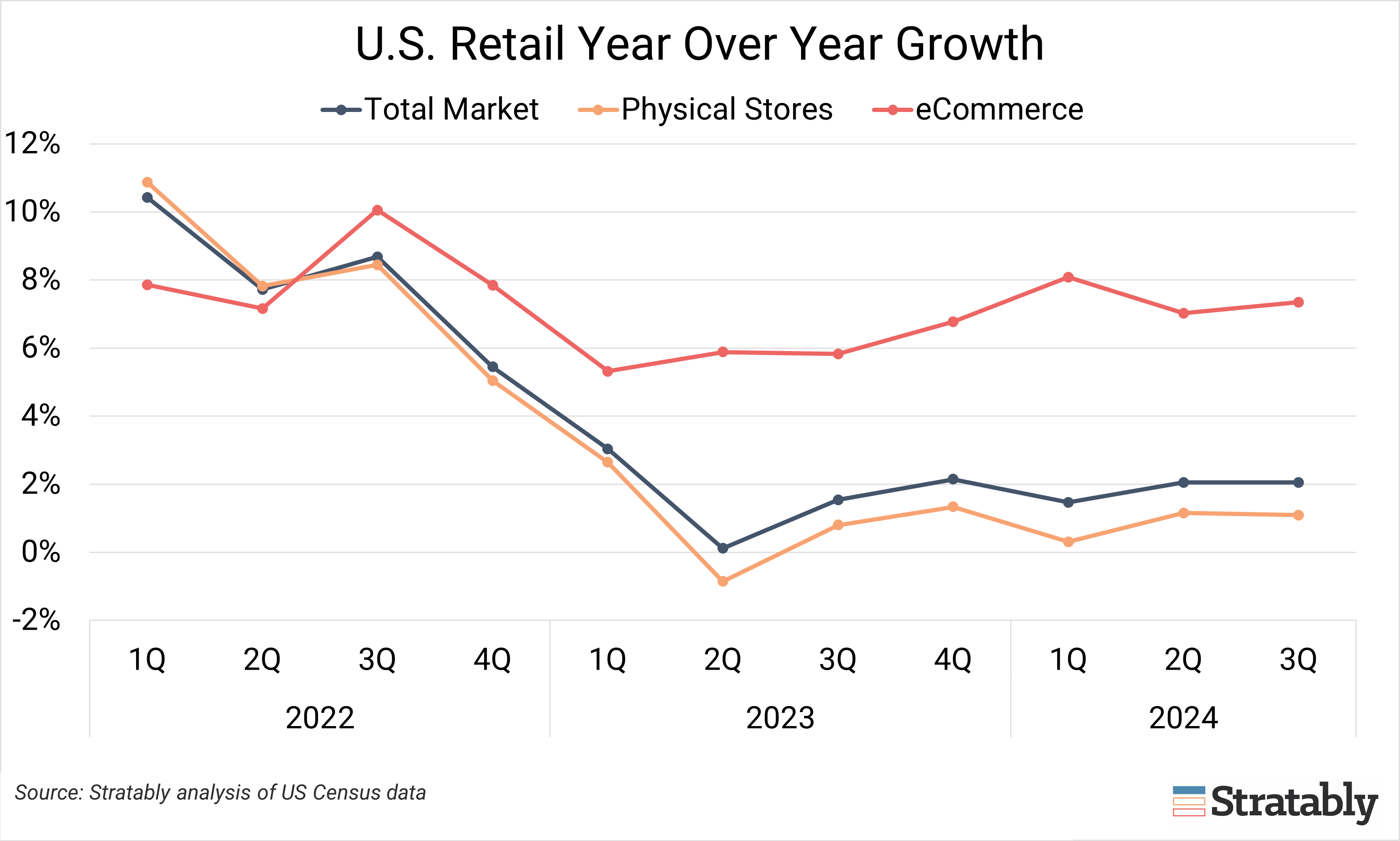

Each quarter, the U.S. Census Bureau publishes estimates for retail sales growth and the split between eCommerce and physical retail.

While channel shifts are less volatile quarter to quarter compared to the 2020-2022 pandemic period, we still monitor the data it to see what it tells us at a high level about the consumer and for context to individual retailer results.

Read on for our analysis of how eCommerce stacked up to physical store growth this quarter.

U.S. Retail Market Growth

The U.S. Census Bureau reported total sales grew 2.1% during the third quarter, in-line with the rate of growth in 2Q.

This result is not all that surprising as the U.S. consumer continues to spend, albeit searching for value in the form of items on promotion and / or innovative new products at opening price points or those offering a compelling price to benefit ratio.

Digital vs. physical store growth

eCommerce grew 7.4% Y/Y, an acceleration from the 7.0% growth in 2Q, and 6.7x faster than sales coming from physical store channels, which grew 1.1% Y/Y.

Digital penetration now accounts for 16.2% of U.S. retail sales in the domestic economy, growing 80 basis points in the third quarter. Year-to-date, the average increase in digital penetration is 84 basis points. Interestingly, this 84 basis point increase is the exact same rate of increase that we experienced pre-pandemic, from 2017 to 2019.

It’s another reminder that the pandemic, and two years thereafter, created a great deal of volatility in channel dynamics, but ultimately the consumer settled back into a familiar pattern of steadily moving more of their spending online.

More on near-term performance: Amazon, Walmart, Target, and Instacart

Digital share of growth

Year-to-date, eCommerce has grown 7.5% and now accounts for 16.2% of total U.S. retail sales. This translates to eCommerce contributing 61% of total dollar growth in U.S. retail sales in the first nine months of the year. 1Q24 was particularly notable, contributing 82% of total dollar growth, while 2Q and 3Q contributions trended in the 52-55% range.

In other words, digital penetration might only be 16.2% but its impact to growth is much more meaningful.

Factors driving eCommerce channel growth

Convenience, selection, transparent pricing, greater information access, immediate gratification, fast delivery, and personalized experiences are combining with demographic shifts (younger consumers, a naturally growing percentage of the population, are heavier online buyers) to create a slow but steady movement towards more spending happening in digital channels.